Retirement Planning is an advice service geared towards helping you remain on track for your intended retirement date. This is mainly done by reviewing your current pensions and future pension needs.

Retirement planning is the process of preparing for your future after you stop working. It involves setting financial goals, saving money, and making investments to ensure you have enough income to live comfortably during retirement. It's about making a plan to secure your financial future and enjoy the lifestyle you want when you're no longer working.

Retirement planning is important to ensure a financially secure retirement and avoid running out of money in later years.

Retirement planning in the UK involves several key aspects to consider and understand, these are:

Understand the UK State Pension system, including the age at which you become eligible and the amount you may receive based on your National Insurance contributions.

Assess whether you're enrolled in a workplace pension scheme, such as a defined contribution or defined benefit pension. If eligible, consider making regular contributions and take advantage of any employer matching contributions.

Explore options for personal pension plans, such as a Self-Invested Personal Pension (SIPP) or a Stakeholder Pension. These allow you to contribute additional funds towards your retirement and benefit from tax advantages.

Take advantage of tax relief on pension contributions. In the UK, you can receive tax relief on pension contributions up to certain limits, which effectively increases the value of your savings.

Determine when you want to retire and consider whether you can access your pension savings without penalties. The UK government has specific rules on when you can access pension funds, usually from the age of 55.

Decide on an investment strategy for your pension funds. This may involve choosing between different investment options, such as stocks, bonds, and funds, based on your risk tolerance and retirement goals.

Consider your overall financial situation, including debts, mortgages, and other financial commitments. Develop a comprehensive financial plan that incorporates retirement savings, budgeting, and any other financial goals.

Regularly review your retirement plan to ensure it remains on track. Adjust contributions, investment allocations, and retirement goals as needed to account for changes in your circumstances and financial markets.

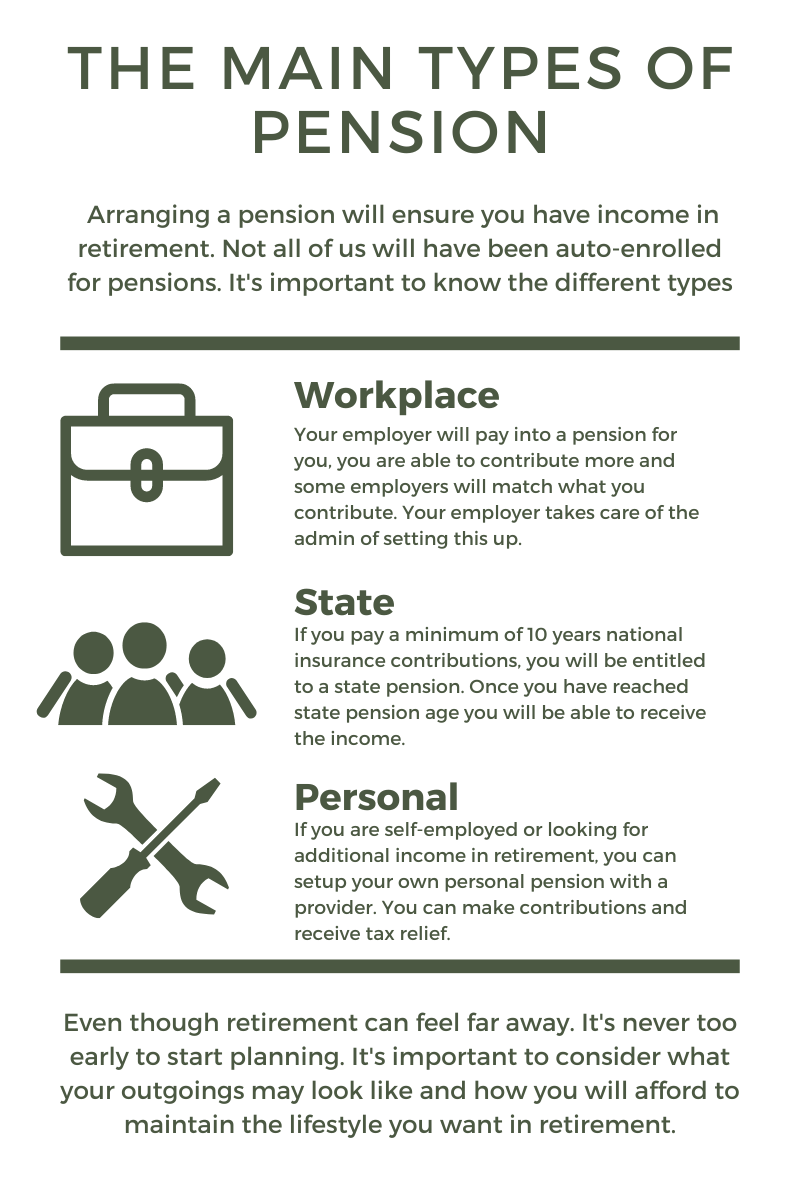

A pension is a savings vehicle designed to provide you with income or a lump sum when you retire. It offers tax-efficient long-term savings. In the UK, most people are entitled to a state pension if they have contributed enough to national insurance. However, relying solely on the state pension may not be enough.

At age 55, you can claim the funds saved in your pension, along with any growth. The UK government allows a tax-free lump sum of 25%. Alternatively, you can use your pension pot to purchase an annuity, which provides a fixed regular income until death.

Start planning for retirement as early as possible. Consider your future expenses and how you'll afford your desired lifestyle. Failing to plan appropriately may prevent you from achieving your retirement goals and enjoying valuable time later in life. Have a well-thought-out plan in place to live comfortably and handle unexpected bills, such as dental or medical fees.

By understanding retirement planning and taking advantage of pensions, you can secure a more financially stable and comfortable future. Remember to consider your contribution limits while building your retirement savings.

The most common type of pension is the Company pension. One which is provided by a workplace. Also known as a Workplace pension.

Your employer must auto-enroll you into a pension scheme and make contributions if you are eligible for auto-enrolment.

To be eligible you must be older than 22, younger than the state pension age, earn at least £10,000 per year and work in the UK.

Most UK companies will auto-enroll you for the company pension scheme as soon as you begin working for them, irrespective of age. However, it is a legal requirement now for companies to offer a scheme should you meet the above auto-enrollment conditions.

One of the benefits of having a company pension scheme is that the company may match your pension contributions.

For example: If you pay 5% of your salary to your pension pot, they may match this by paying in an additional 5%, giving your pension pot a contribution total of 10%

The Personal Pension is sometimes referred to as a private pension. These are also good self-employed pensions.

Those who do not have a company pension, such as the self-employed, may pay into a personal pension, as well as anyone else looking to raise more money for their retirement. Personal pensions are available to anyone and there is no requirement to be self-employed.

The personal pension contributions are invested for growth with the intention of providing a lump sum or annuity upon retirement age.

The State Pension is provided by the Government and the amount you are entitled to will depend on the number of years of national insurance contributions you have made.

You need to have contributed at least 10 years of national insurance contributions to receive a state pension. To receive the full amount available you need to have contributed for 35 years. If you have paid for a number of years in between you will receive an amount based on how many years you have contributed.

State pension entitlement works on a scale. The more years you have paid, the more state pension you will be entitled to. The current state pension is £203.85 a week. It's increases are protected by the state pension triple lock which ensures the purchasing power of the pension does not fall.

The widow's pension has been replaced by Bereavement support payments, which are paid to widows and civil partners for 18 months following the death of their spouse.

To be eligible for Bereavement support payments, the claimant's partner must have paid national insurance contributions for at least 25 weeks, or have died at work due to an accident or disease caused by work, and the claimant must be under the state pension age and living in the UK. Bereavement support payments are not means-tested and can be used to help pay bills, pay debts, or for funeral costs, and there are two payment tiers (higher or lower band) depending on your eligibility for child benefit.

Part of retirement planning will be organising your pensions and arranging any pension transfers to increase suitability and investment performance, or even reduce fees.

By transferring Pensions, you can make your pension management easier and clearer to follow. You will be able to take control of what fees you pay and reviewing your pensions may even result in fewer annual charges.

You might want to move your pension if:

If you are transferring pensions when moving abroad, a QROPS (Qualifying Recognised Overseas Pension Scheme) is used. A QROPS pension transfer is the process of transferring a pension from a UK pension scheme to a pension scheme located in a different country that is recognised by the UK government.

If you do not use a QROPS when transferring abroad, you may be liable for tax on your pension income and lose the benefits of your UK benefit that the government allowed.

Remember, retirement planning is a long-term commitment. Regularly reassess your goals, stay disciplined with saving, and adapt your plan as needed. By taking proactive steps now, you can enhance your financial well-being and enjoy a comfortable retirement.

A pension transfer is when you move your pension from one provider to another. As you approach retirement you may want to consider moving your pension if another provider can offer you a higher annuity or other benefits.

It's important to review your options upon retirement and obtain a full pension review. This will allow you to understand the full details about your options and whether you are on track to retire. It will not always be the case that you are better off transferring your pension. You should seek advice from a Financial adviser around this.

Workplace pensions allow your employer to contribute to your retirement fund. You can also contribute, as a tax efficient money sacrifice directly from your salary. This means you do not pay income tax on the funds you sacrifice to your pension. This money is then invested accordingly into the stock market in certain global funds and units, chosen by your provider. You should seek regular pension reviews and upon retirement or minimum age 55, you will be able to claim your funds with up to a 25% tax free lump sum.

No, you will not lose your pension. However, all contributions will stop, including those from your employer. Your funds will continue to be managed by the pension provider. You can opt to freeze it if you wish. Freezing a pension means it stays as cash until you are ready to retire.

After age 55, you can claim your pension funds whenever you choose to, so it really never is too late to start a pension.

Seeking financial advice around your pensions will allow a qualified professional to review your retirement goals, the current performance of your pension, as well as the fees being charged. It may be that some of this information you are unaware of and sitting down with a financial advisor will help you to plan accordingly. Financial advisers are able to move pensions to different providers if they fit your needs better.

First step is to contact your previous employers and ask them for the details of the pension provider during the period you worked at the company. If this doesn't work out, there is a government pension tracking service. It’s a free service that searches a database of over 200,000 personal pension and workplace schemes. https://www.findpensioncontacts.service.gov.uk/

You are able to withdraw the full value of your pension in one lump sum. You will receive the first 25% tax free and pay income tax on the remainder. Seeking advice will help you decide the best, most tax efficient way to withdraw your funds.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  Leicester, Leicestershire

Leicester, Leicestershire Initial fee free consultation

Initial fee free consultation

Is the Triple Lock State Pension Still in Place?

Explore the arguments for and against replacing the triple lock with a double lock state pension.

Discover Does the Triple Lock apply to the Additional State Pension.

State Pension 8.5% Boost What's Changing in April 2024?