Buy-to-let mortgages are loans for people who want to buy a property and rent it out to tenants. These mortgages are made for landlords and property investors, not for people who want to live in the property themselves.

With a buy-to-let mortgage, the property's rental income is taken into account to decide the mortgage affordability, alongside the borrower's personal income and financial situation. The loan amount and terms are usually based on the potential rental income, as well as the property's value.

Buy-to-let mortgages can be an attractive investment option for buyers looking for rental income and growth in property value. However, it's important to carefully consider the financial implications, responsibilities of being a landlord, and potential risks associated with property investments before proceeding with a buy-to-let mortgage.

Buy to Let mortgages are not only available through a personal name, but also as limited company Buy to Lets. There can be tax advantages to buying to let in this manner, but it is advisable to speak with your accountant and mortgage adviser before deciding how to proceed.

Buy-to-Let mortgages have different rules and pricing compared to residential mortgages. Affordability is based on rental income and other factors. A deposit of at least 25% is usually required. Most borrowers choose interest-only terms, paying only the interest each month. They repay the capital at the end of the term, often by selling the property. Capital repayment options are also available. Some lenders require applicants to be over 21 and have a minimum personal income, typically around £25,000 per year, which is more common for first-time landlords. Some lenders also decline buying to let as a first time buyer.

You need to consider if you can afford the repayments even when you do not have tenants in place. There may be times when the property is unoccupied, and you won't have rental income. Be sure you can afford to cover these periods in-between tenancies. If you are buying to let for a short term period, you may want to consider a serviced accommodation mortgage instead.

There are tax implications to consider with buying to let:

When considering a buy-to-let property, two important factors to know are the required deposit and the amount you can borrow on buy-to-let terms.

Factors like credit scoring and lender policies can affect your approval chances. Speaking with an adviser can give you an idea of what's possible.

Typically, a minimum deposit of 25% is needed, with the remaining 75% as your loan.

In some cases you may need to provide evidence that you have enough income to cover your personal expenses during periods of vacancy, this may be payslips or SA302s. Lenders will assess your affordability, considering potential periods of vacancy.

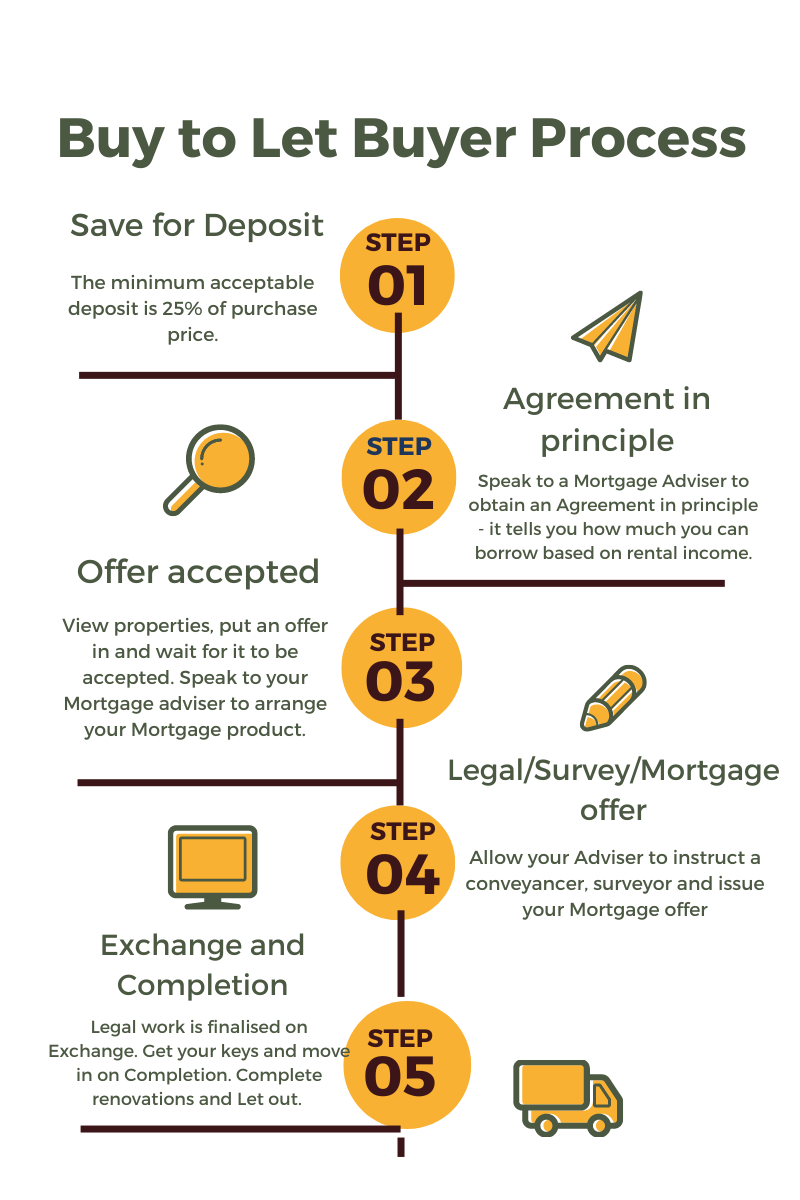

Conveyancing, surveys, and a mortgage offer are still necessary, leading to contract exchange and completion.

You can still obtain a Mortgage promise for Buy to Let mortgages. The document confirms, based on everything remaining equal, how much you would be able to borrow to buy your rental property.

Mortgage promises are important as they confirm in writing your worthiness for credit. Many estate agents are now asking to view this before accepting your offer on properties they have listed.

Buy to Let Mortgages use different affordability calculations from residential Mortgages. This involves looking at how much rent the property would generate, and whether that would cover the mortgage by 125%.

For Example:

If this affordability test does not stack up, you could consider putting a larger deposit down, increasing the term of the loan, or using an interest-only repayment method.

Be aware, these policies and affordability assessments will vary from lender to lender. A mortgage adviser working with a panel of lenders will be able to understand your specific circumstances and help find a mortgage that works for you based on your available income, deposit, and rental valuations.

Buy-to-let mortgages have varying fees depending on the lender. Unlike residential mortgages, they often come with a product fee, paid upfront to the lender. Remortgaging after two years may incur new fees, adding to expenses. It's crucial to calculate the long-term costs of the mortgage.

On average, the product fee for a buy-to-let mortgage is around £1,500. Keep in mind that a larger deposit, such as 40%, can potentially secure a lower interest rate.

Additionally, buy-to-let mortgages generally have higher interest rates. When comparing rates, consider the overall cost, including the product fee, to ensure cost-effectiveness.

In the UK, we have Second home stamp duty. Depending on your purchase price, if you buy an additional property, you will pay a tax surcharge. This is paid via your solicitor upon completion of your purchase.

The current tax policy in the UK applies a surcharge of 3% to each stamp duty bracket for buying an additional property. The latest information on Stamp duty can be found on our stamp duty calculator.

If you want to let out your property but are unable to remortgage to a Buy to Let mortgage, you can consider applying to your lender for Consent to Let. Consent to Let is a written agreement that confirms your lender will allow you to rent out your property whilst on residential mortgage terms.

When entering the Buy to Let market seeking Mortgage advice is crucial. A mortgage adviser can help you to assess the costs and risks of buying to let. Buying to Let, for most people, is about making a profitable investment. A mortgage adviser can help you to keep your costs down by finding the most suitable mortgage product for you. They will be able to provide advice on whether you can afford to proceed on a repayment or interest only basis.

This type of mortgage repayment method is where the monthly payments are calculated to only pay the lender the interest for borrowing the funds. There are no repayments to the loan capital being made. This means that at the end of the loan, the initial debt will still need to be repaid. In order to qualify for an interest only mortgage you must have a repayment vehicle for the end of the term or this is commonly used on buy to let mortgages.

The deposit required varies from lender to lender, typically 20%-40% is required. A mortgage adviser could provide options around how deposit amounts impact the rate of interest and what is best suited for your needs.

Eligibility for buy to let mortgages can vary between lenders. Some have introduced policies where the borrower must have minimum incomes, minimum age, or cannot be a first time buyer. A mortgage adviser will be able to look at a wide range of lenders to take your circumstances into account and offer options around what is best for you.

If you have the minimum deposit, the affordability checks can be calculated on the rent generated, this being used to then cover the loan repayments. Some lenders look at rental income being 125% of repayments in order to pass their checks. Other lenders require that you have a personal income of £25,000 or more.

Buy to let mortgages are usually available through Mortgage advisers who generally have access to 1000s of mortgage products across 100s of lenders. Sunny Avenue has listed Mortgage advisers from up and down the country who will be able to help provide more information on buy to let mortgages.

A buy to let mortgage requires a deposit of usually a minimum amount of 25%. Interest rates on buy to let mortgages are normally higher than residential mortgages. Many lenders also charge a product fee. Then there are the other costs, such as conveyancing and surveys. Once purchased, you will face ongoing landlord costs for contracts, landlord insurance and potentially income and capital gains tax.

If you buy a second home you must pay the stamp duty surcharge amount. This is 3% on top of the usual stamp duty rates applicable.

Loan to value is used to calculate what rate of interest you will pay on a mortgage. It is calculated as Mortgage amount outstanding/Current value of the property. If a £200,000 property has a mortgage of £150,000 LTV is 75%. Mortgages are then priced in brackets, for example, 75%-90% LTV is a set interest rate. It can therefore be favourable to make early repayments to attempt to drop into a lower interest rate bracket.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

Discover how swap rates affect mortgage interest rates.

Understand the difference between Consent to Let and Buy to Let mortgages.

Explore the advantages, considerations, and buying process of freehold property ownership.

Discover the intricacies of what are the 3 main searches when buying a house?

Find out what happens if you get caught living in your buy-to-let property.