If you're wondering about your entitlement to a widow's pension, you may be referring to the "bereavement support payment" (BSP), which replaced several other benefits in 2017. BSP is designed to help widows transition financially after the loss of a loved one, and you may be eligible to claim it

In this insight, we are covering the detail about the benefit and settle any confusion about the widow's pension.

Widow's pension is now Bereavement support payments, paid for 18 months after the death of a spouse, consisting of a lump sum and 18 payments, and to be eligible, the partner must have paid national insurance contributions for 25 weeks, or died at work, the claimant must be under the state pension age and living in the UK, the BSP is tax-free and not means-tested, and can be used for bills, debts, or funeral costs.

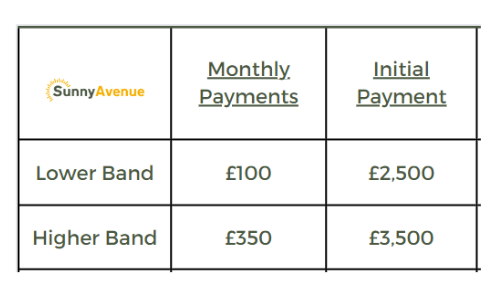

Under the old widows' pension scheme, if a woman's spouse passed away, she may have been eligible for a weekly pension of up to £122.55. However, this scheme has been replaced by Bereavement Support Payments, which provide a one-time tax-free lump sum of either £2,500 or £3,500, followed by 18 monthly payments of either £100 or £350, depending on the individual's circumstances.

For example, Sarah's husband passed away in October 2022, leaving her to care for their two children alone. Sarah is 40 years old and lives in the UK. Her husband had paid National Insurance contributions for at least 25 weeks, so she is eligible to claim BSP.

Sarah applies for BSP within three months of her husband's death and is approved for the higher band of payments. She receives a lump sum of £3,500 tax-free, followed by 18 monthly payments of £350.

Sarah uses the BSP to help cover the costs of her husband's funeral and to pay off some of their outstanding bills. With the financial support of BSP, Sarah is able to focus on caring for her children during this difficult time.

Bereavement support payments has payment two tiers. The higher or lower band.

You are eligible for the higher rate payment if you are entitled to child benefit. If you aren't then the lower rate is paid, unless you were pregnant when your spouse died.

The payments run for 18 months following the death of your spouse. They are paid to the widow or civil partner. The widow's pension is now under the umbrella of Bereavement support payments, which has previously replaced the widow's pension, bereavement allowance, and bereavement payment.

Payments will cease if you die during the 18 months. Your next of kin will not be eligible for any further claim.

You will need to claim the bereavement support payment instead of the widow's pension following the update in 2017.

You need to claim within 3 months of your spouse's death. If you claim later, you could get fewer payments.

You will need:

Claims can be made online, by post, or by phone.

To begin a claim online, use the Gov website: How to claim for Widows Pension

The gov.uk website is where you can also download the relevant postal forms. If you cannot download them, you can phone the bereavement service helpline on 0800 151 2012 or visit your local 'jobcentre plus'. They can provide you with the forms.

If you are over the state pension age, you may be able to claim an increased state pension. What you are entitled to depends on when you reached state pension age. If you reached the state pension age before April 2016, contact the Pension service to find out what you are eligible for. This figure can change in line with the state pension triple lock.

If you reached the state pension age after 2016, you may be entitled to an increased state pension. This is to account for your spouse's national insurance contributions.

You can find more information on inheriting an increased state pension on the gov website: Inheriting an increased state pension

If you are unsure of how to manage your inherited pensions, you should consider seeking advice for retirement planning. A financial adviser will be able to help you plan for your retirement. Financial advisers will consider the benefits you are entitled to.

It can be a difficult time when you are mourning a loss. Navigating pensions and annuities can add additional stress. Talking to a financial adviser can help relieve the stress of making decisions alone.

If you have recently lost a loved one, there is support available at helpguide.org & the NHS websites

If you are unsure where to start with retirement planning or estate planning services, you can complete the Sunny Fact Find for financial advice. The answers you provide help us to find the best-suited adviser. Your adviser then contacts you for a no-obligation conversation on how they can help. You decide how to proceed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  Leicester, Leicestershire

Leicester, Leicestershire Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.