Being a Home-mover simply means you aren't a first-time buyer but are moving homes. You are on the property ladder now and are either looking to upsize, relocate, or downsize.

There are a few differences now from your first-time buyer process. The obvious difference is the likelihood that you are in a chain - waiting to sell your home before you can move on. Other differences include:

Being in a chain can add a lot more stress to the home-moving process, it creates additional factors that are out of your hands. For example, you will not have control over how many properties are in your chain, and how quickly they progress. They simply may not be as keen as you to complete.

It will be frustrating if you encounter a hold-up in the chain because certain administrative tasks have not been completed by the rest of the property owners. There is only so much your own conveyancer will be able to help with.

A good conveyancer will proactively manage the chain and keep you as updated as possible.

Conveyancers can be appointed by your mortgage adviser. Your adviser should then be provided a client portal where they can log in and track progress.

When the time to complete arrives, your conveyancer will handle the completion day admin, including the movement of funds through the chain.

The completion date will be agreed upon up-front, usually a week before. The average home move can take around 6 months to complete. Waiting another week can be frustrating, but this time is to be used for you to arrange removal vans and a day off work.

On the completion date, in the best cases, you will have had confirmation by 11am. This is when you are free to collect your keys from the agent and begin moving in. In the worst-case scenario, an unexpected hold-up occurs and the CHAPS payment deadline is missed. Banks set their own deadlines for final submissions, normally around 2.30-3pm. If the payment does not arrive, completion will need to be delayed.

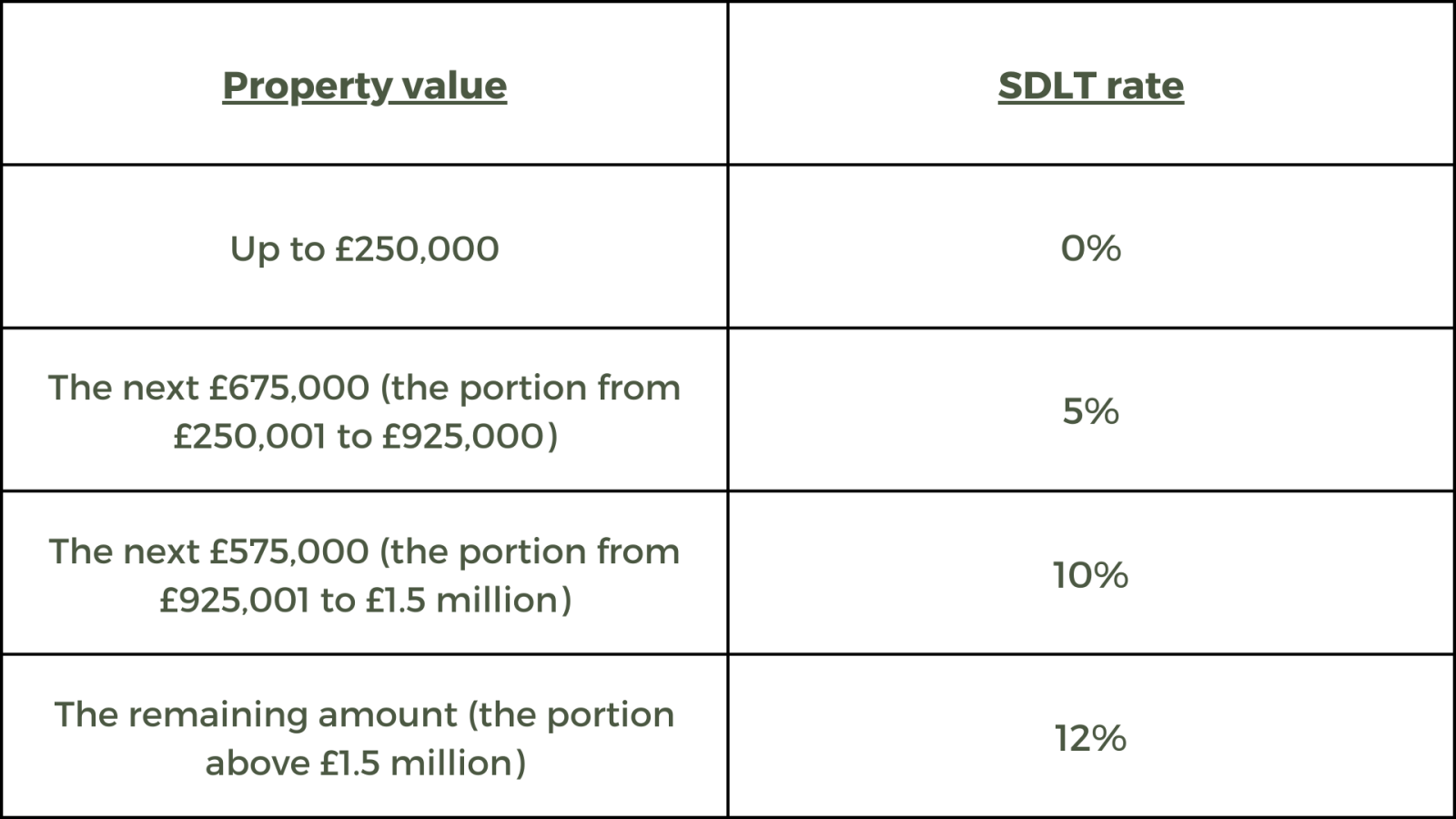

Stamp duty land tax applies to property purchases only. When you buy your next home those stamp duty rates you had at a discount no longer apply to you. So what is different?

As a first-time buyer, you do not pay stamp duty up to £425,000. Unfortunately, as a mover, the stamp duty now kicks in at £250,000. If you are planning on keeping your old property and buying another home, you will need to be aware of the Stamp duty surcharge. The surcharge adds a 3% increase to each bracket. You can pay your stamp duty and land tax from the sale proceeds of your house.

The bill due is settled by your solicitors upon Completion.

If you do intend to keep your existing property or are buying a second home, you will need to pay a 3% stamp duty surcharge on top of the above rates.

For the latest up-to-date information on Stamp duty, please review the Government site: Stamp duty rates

If you are buying in Scotland or Wales you pay land & buildings tax or Land transaction tax respectively. Calculators are available to help you see how much you would need to pay.

As a home mover, you already own a property, and generally, when you move, you sell that property to partly fund the new one you are buying.

Before you know what price of new properties you can hunt for, you need to value your existing property. This will give you an idea of how much equity you have.

Yes, you can use your equity as a deposit for moving house. Equity is the value of the property owned without any outstanding mortgage.

For Example, If you have a property valued at £200,000 and a mortgage of £150,000 - you have £50,000 in equity.

Once you remove the costs of moving, if you have no further funds to add, this figure of equity is used for your new deposit. Your deposit can be made up fully of equity from your house sale.

The amount of equity you put forward will calculate what interest rates you are eligible for.

The larger the deposit/equity, the lower the interest rate you will be entitled to. This is because Interest Rates are determined by Loan to Value.

Loan to Value is calculated as the mortgage amount outstanding divided by the value of your home, expressed as a percentage.

For example, if your buy a property of £200,000 with a deposit of £50,000 and a Mortgage of £150,000, your loan to value is 75%.

= 150,000/200,000 * 100 = 75% Loan to Value.

The Loan to Value percentage will fall into a range of LTVs that have been given pre-determined interest rates. For example, a bracket could be 70-80% or 80-90%. The LTV bracket would then entitle an applicant to set interest rates.

When moving home you may want to enquire about how much more deposit would be required for your application to drop to a lower interest rate bracket and potentially lower your repayments.

From time to time, the government will introduce a new homebuyer scheme. These schemes may allow you to borrow money from the government at preferential terms. The latest scheme was the Help to Buy equity loan. The Help to buy equity scheme stopped taking applications on 31st October 2022.

If you are looking to find out more information on government schemes you can speak with a Mortgage adviser who will be up to date on the details if any schemes are suitable for you.

Mortgages Porting allows you to move the terms of your existing mortgage to a new property without paying an early repayment charge.

You will only be able to port the existing Mortgage by staying with your existing lender. Not all Mortgages are portable so it is worthwhile checking upfront.

Porting a mortgage will be beneficial if you have interest rate terms that are better on your existing mortgage than what you are being offered for a new one. That could occur because your new property's Loan to Value is higher than your current property.

If you want to borrow more money, you will be able to, but not on the same terms as the current Mortgage. New terms will be agreed upon on your additional borrowing, including a new interest rate.

This is where you can end up with sub-accounts within your Mortgage.

Having Mortgage Sub accounts is essentially splitting your mortgage into different parts into different split terms.

When you port your Mortgage and borrow more to fund your new home, you will end up having two sub-accounts. One sub on the existing Mortgage terms, and the other on the extra amount borrowed and new terms agreed.

If you are still within your fixed term when looking to move home, you will not incur Early Repayment Charges by porting your existing mortgage.

A Mortgage adviser will make a recommendation on whether it is an option to port your mortgage or not. It may be worthwhile porting to avoid paying early repayment charges until your fixed rate expires.

Porting is only available if you are staying with your existing lender. You will not be able to port to a different lender.

Moving home will have a similar process to buying your first home. Similar tasks will need to be undertaken, which will cost you. The bill for these costs will be paid at separate stages. Most of which can be paid upon completion.

A new fee you will need to pay would be the cost to market your property, the estate agent's fee.

Estate agents offer marketing services for a fixed fee or a commission of the sale.

Moving home is said to be one of the most stressful circumstances you can go through. By dealing with a mortgage specialist you can put all your mortgage stresses to one side and let your adviser guide you through this change. Sunny Avenue are here to help connect people with an adviser to help. Get started with your home mover journey by connecting with an adviser today.

Mortgage porting is when you move the terms of your mortgage from one house to another. This is often used when moving home and particularly when upsizing. By porting your mortgage you do not pay early repayment charges. The existing borrowing amount outstanding remains on its terms whilst any additional borrowing is added to a new sub-account in your mortgage on new terms. If you are downsizing, you can still port your mortgage to take advantage of preferred terms, however, you may still incur an early repayment charge on the amount you are paying back early.

Porting your mortgage would be beneficial if you can avoid early repayment charges, or the interest rate you can port is less. Mortgage porting won't be for everyone. You may find your existing terms are no longer appropriate for you.

It is a good idea to speak with a mortgage adviser before searching for your next home. This is so they can confirm how much you can borrow and that you're still eligible. If your circumstances have changed, you may no longer be able to borrow as much as you had hoped. The mortgage adviser can issue you an agreement in principle to confirm.

It is expected that all mortgage advisers will be able to help review your home-moving needs. You can find a mortgage adviser who helps with home-moving through Sunny Avenue.

It is a good idea to seek advice when porting a mortgage, many variables could impact if you do or do not benefit from porting. This includes, the amount of equity you have, the length of term remaining on your existing product, and the current market interest rates. A mortgage adviser will make a recommendation based on your circumstances before you proceed to ensure Porting is the best outcome for you.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

13% of women are pregnant at any time, meaning there is a significant number who may be considering getting a mortgage.

Worried about missing important details in your purchase? Learn if it's typical to go for multiple viewings after offer.

In this insight, we explain how to find the answer to when did I move into my house?

Viewing houses before yours is on the market can be a risky approach, often leading to disappointment.

Discover how swap rates affect mortgage interest rates.