If you're a first time buyer, looking at properties without knowing what is achievable for you. The last thing you want is to fall in love with a property that you can't afford to buy. That's where the mortgage promise comes in to play.

In this insight, we will cover all you need to know about how the first stage of the mortgage process works as we tackle the question, what is a mortgage promise?

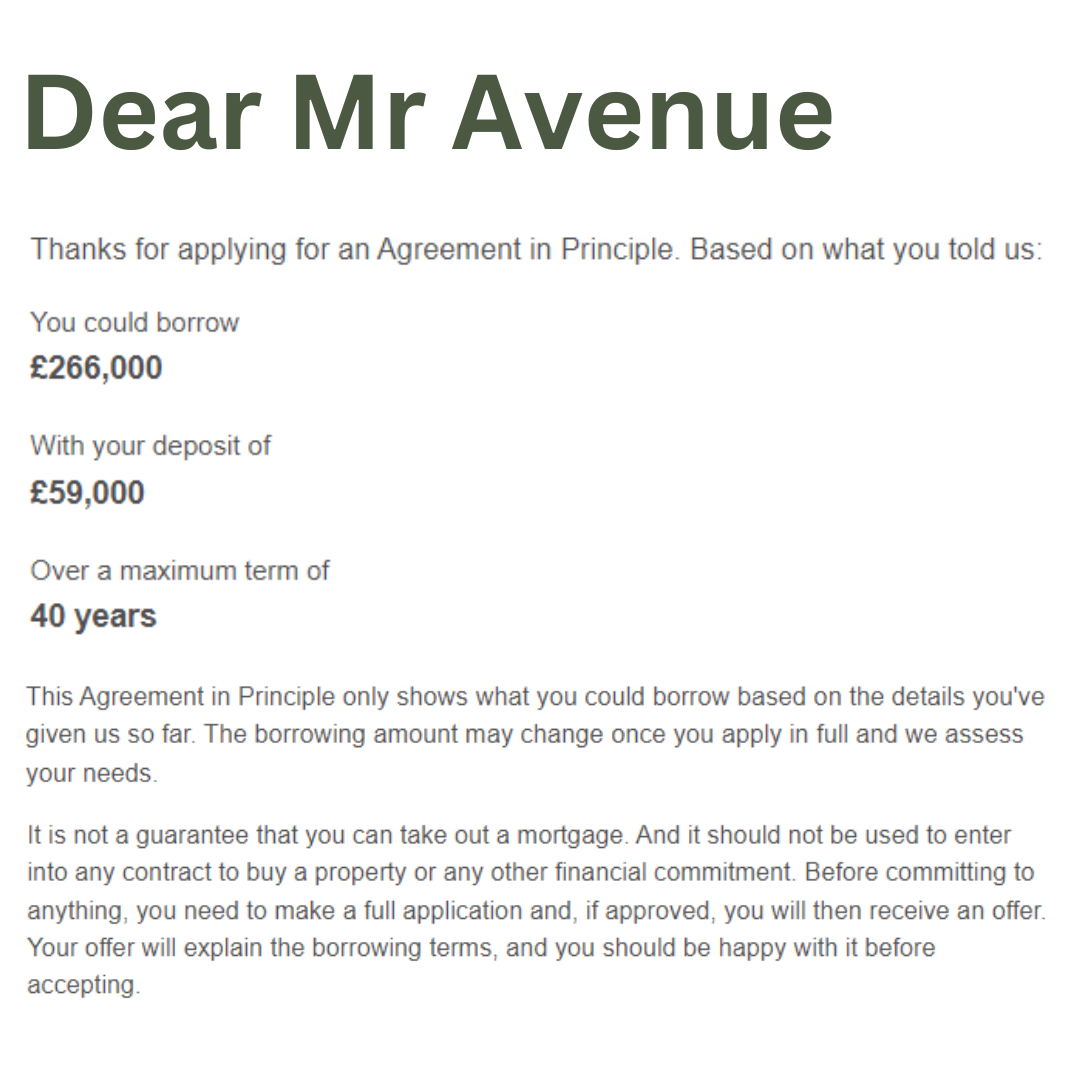

A Mortgage promise is a document that confirms how much you can borrow for a house. Lenders assess your affordability and agree to an amount they would be willing to lend. The Mortgage promise is also known as a Mortgage in Principle, a Mortgage Decision in Principle, or an Agreement in Principle.

It is simply your affordable loan amount. It's used to consider what properties are affordable for you. When you are ready, considering the loan amount and your deposit, you can put offers in for houses you like.

The mortgage promise includes your name, the lender's logo, and the loan amount available.

Lenders have different information on their mortgage promises. For example, some include the maximum term available. That is determined by your age and retirement age.

Does a Mortgage in Principle mean you will be accepted? No. The mortgage promise is not a guarantee. It serves as a guideline to understand realistic house options. Your income and credit score will be checked to provide assurance, but the bank can still reject your application later. The full mortgage application process is the only way to obtain a guarantee.

If at this stage you find you cannot borrow as much as you thought, you may want to enquire about the possibility of a Joint Borrower Sole Proprietor Mortgage.

Read our insight: Buying a House for more information on the step by step house process.

The only way to obtain a mortgage promise is to speak directly to the lenders or your mortgage adviser.

You may need to book an appointment, or can try to apply online. You will be asked a series of questions about your income and expenditure. At the end, a soft credit score check will be run and your decision amount provided.

Each lender has a different affordability assessment. That means the maximum loan amount each lender will vary. Sometimes, one lender may not be able to lend as much as another. For that reason, it is a good idea to seek advice from a whole of market mortgage adviser. The whole of market mortgage adviser has access to a panel of lenders and can obtain a decision from many lenders with just one application. If you tried to arrange this yourself, you would need to individually apply for a mortgage promise with each lender. That will take too much time.

During this process, the lender is going to ask you questions about your income and expenditure. Calculating the amount you can borrow is not going as simple as stating your income.

Lenders have rules to follow. Ways to assess your income, which may differ from how you assess your own income. For example, a lender may not take into account certain types of income, or they may only take into account a percentage of income. Income such as Bonuses and overtime may be calculated to only include 60%, where income from expenses will be considered non-allowable income.

The lender may also assess income using your last month's payslip for basic income, or your last three months if you have any fluctuations. An average will then be calculated. As the agreement in principle is not the finalised loan amount, but simply a guideline for you, if your income changes to a lower amount when it is time to apply for the full mortgage, you may be assessed to only be able to afford a lesser amount.

For these reasons, it is advisable at this point to provide proof of your income. Here is what's required:

There will be an expiry date provided on the agreement in principle, this is generally 3 months after the date it is produced. The expiry date is required so that the lender can re-assess your circumstances, ensuring your loan amount is still affordable.

However, if there are no changes to your income. It will be likely that the loan amount will show no change. If the loan amount does change, this may be due to changes in the lender's policy.

After your Agreement in Principle expires, it does not mean you need to stop looking at properties. To refresh the AIP, all you need to do is make a quick call to your mortgage adviser and they will reassess any changes, sending you an extended document.

You will not be charged to apply for an AIP from the lender. Some Mortgage advisers may charge you a fee for their time. If they do, it will make this clear to you before any meetings.

Speaking to many lenders may cost you your time. Some lenders still insist on clients meeting with a qualified mortgage adviser to provide an AIP. That could involve waiting for availability, or needing to book a few different appointments.

It's possible to obtain an AIP online. This will be generated on the same day and sent via e-mail to you. If you use online services you need to be aware that the AIP provided to you will be based on the information you have input. Should you make any error with inputting data it could lead to an incorrect AIP and possible disappointment.

It is possible to arrange AIPs over the phone with an independent Mortgage adviser and still have these sent, via e-mail, on the same day.

If you have complicated income types, It is a good idea to speak with a Mortgage adviser. They will be able to input your income figures correctly, which should avoid any disappointment later down the line that you may face doing the agreement alone.

When you apply for a mortgage promise, you will need to have a credit scoring check completed. This is either be a soft, or hard credit check.

Soft credit checks look into your credit report, without leaving a mark to show you are applying for credit.

A hard credit check will leave a mark on your profile to indicate that you are applying for credit. Most lenders only apply a credit mark at the full application stage, however, if you are going to be reviewing your circumstances with many lenders it is worth asking what type of credit checks they will be running.

If you have too many credit checks on your profile it may look like you are looking for lots of credit and that can put lenders off.

Mortgage advisers who use a panel of lenders will only run one credit check as often their lending systems have agreements with all lenders on their panel to use the same checks to provide affordability, and agreement in principle results.

It is possible to request a mortgage promise for a Buy to Let. However, as the lending assessment differs from residential mortgages, the agreement in principle may be less accurate.

It will confirm your credit score is acceptable and provide details of the maximum loan term available. However, as the maximum mortgage loan amount is based on the rental income that can be achieved from a property, more often it will be based on estimates, rather than hard evidence. This could lead to disappointment at the full application stage if the rental income achieved or valued is not as high as expected.

There are a few points to be cautious about when relying on a mortgage agreement in principle:

Your agreement is based on the information provided on the day it is agreed upon. Despite the AIP lasting for three months, should your circumstances change, the loan amount can change also.

The AIP is not a guarantee. The lender can pull from the market, or specifically change the decision for you based on policy changes.

If your income calculated was using an average, when you find a property if your average income has reduced it may impact your ability to borrow as much as agreed in the AIP.

At the full application stage, a new credit check will be completed. If your credit score has changed or you have taken new credit, it will impact the amount you can borrow.

The assessment is based on the income figures you have provided, if you do not have help from a Mortgage adviser, you may input incorrect figures and that will invalidate the agreement in principle.

The lender who offers the highest Agreement in principle amount may not have the best mortgage for your needs. You will still be able to change lenders, if required, at the point of Full Application.

It is possible to make an offer without an agreement in principle. However, this is not advisable as it may lead to disappointment down the line. For more information on viewing properties without a mortgage promise, read our insight: Can you view a house without a mortgage promise?

Due to a competitive market, vendor agents are more frequently asking for an agreement in principle when accepting offers on a property. Obtaining a Mortgage in principle shows you are serious about buying and have had relevant checks completed.

An example of an online Mortgage agreement in principle provided by a high street bank. These AIP's can also be provided by a Mortgage broker.

If you are looking to arrange a mortgage promise, you can use the Sunny Avenue Fact Find to get started. The answers you provide help us to find the most suitable adviser. Your adviser then contacts you to discuss how they can help. You decide how to proceed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Cheltenham, Gloucestershire

Cheltenham, Gloucestershire No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.