Every parent wants their children to have a bright future, and a quality education is part of that. However, paying for school fees can be an expensive and daunting task. That's why having a solid plan for school fee payments is essential. In this insight, we'll discuss the concept of school fee planning, including its benefits, various strategies, and services available to help you manage your finances and ensure your children get the education they deserve.

A School fee plan involves planning ahead to fund future school fee costs. This could be for your children or grandchildren. It involves investing for growth. You will be set up with an investment plan that aims to meet the required value by a set date. The set date is the date the fees would be due.

A school fee plan needs to take into account inflation and tax. The earlier you start planning, the better.

The investor is provided with an expected growth value and an assessment of how to achieve this sum.

When you sit down with your adviser you will need to establish a savings plan. This plan needs to take into account a few different factors:

The end goal of establishing your savings plan is to find how much you will need to regularly invest to hit your goal. You will identify if it is realistic, and what to do to bring it back on track. You may be required to contribute an initial lump sum as well as regular payments. The longer the length of your plan, the more time you allow for the investment to grow. A longer plan may allow for a lower regular savings amount each month. School fee plans are flexible to your needs

Other than making a regular investment, there are other strategies that are considered as part of school fee planning. These options may not be right for everyone, but they will be considered during your review.

If you are expecting to be gifted funds from grandparents or anyone else, a tax-efficient way to save would be to use Trusts, specifically a Bare Trust. The Trust will allow for the legal transfer of ownership of the gift value from the Giftor to the child. The child's personal savings and tax allowances can then be used to maximise growth without the need to pay tax. This is popular as it is normally the case that the Giftor would have used all of their allowances and would need to pay tax on any investment growth via capital gains tax.

If a Bare Trust is used, it will need to state that funds are for the intention of school fees. Otherwise, when the child turns 18, the money would be legally theirs to access.

A gift of up to £3,000 can be provided annually without paying inheritance tax on it, should it become liable. Inheritance tax would be due for all amounts above if the Giftor dies within 7 years of making the gift. Taper rates would apply.

Read more about Inheritance Tax Planning and the inheritance tax 7-year rule.

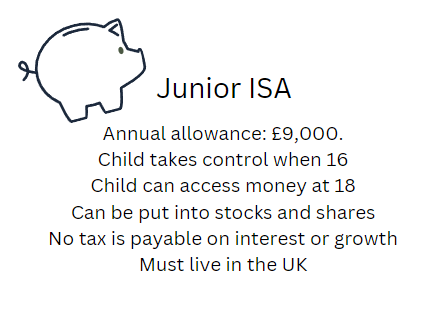

If you are saving for university fees, a junior ISA will provide tax-relief on any interest earned. It works in a similar manner to a regular ISA, except withdrawals are not allowed until the child reaches 18. The JISA can be transferred and placed into a Stocks and Shares ISA.

Money paid directly into a junior ISA does not count towards inheritance tax. These payments are exempt and sit outside of the estate.

Yes. It is possible to setup a limited company and place assets under ownership of the company. You will then be able to make your children share-holders of the company. The dividends from the profit created by the assets can be used to pay for the school fees.

School fees are not deductibles, although they can be paid through a business. If you do use a business to pay the fees, they can still fall under your personal liabilities. It's important to seek tax advice if this is an approach you choose to take.

Some school fees offer the option to pay in advance. If you pay in advance, you agree a fee upfront. The school can use the money to put into low risk investments. As many schools are classed as charities there are less tax complications. This method allows the school to benefit from investment growth and reduce the effects of inflation. You will need to decide which school you are looking at to agree a payment upfront. This can be taken into account when you review your options with your financial adviser.

School fee planning can provide benefits for you and your family. One of the benefits is by budgeting and having regular reviews you can make sure you stay on track for your school fee target value. If you need to make changes to your plan, you will be able to do so. If you choose not to plan, you could find your finances off track and never reach your goal.

School fee planning can also help you save money in the long-term. If you utilise your tax options, stay on track with your savings plan and your investment performs in line with expectations, you could save money overall.

School fee planning can also help reduce the stress and anxiety associated with paying for school fees. With a plan in place, you can be sure that your children’s education is taken care of, and that you are not overspending. This can help you feel more in control of your finances and reduce the amount of stress that paying for school fees brings.

You will need to seek advice from a financial adviser. A financial adviser will be able to review your options and put any relevant plans in place.

You may need to review other areas of your finances as you review your school planning needs. For example, you may want to think about putting life cover in place that could cover the cost of the fees should anything happen to you. Many parents also consider borrowing money to cover school fees. If this is an option you want to consider, a financial adviser will be able to make a relevant referral for you to consider this.

If you're unsure where to start with school fee planning, complete the Sunny Fact Find for investment planning. The answers you provide help us to find the best-suited adviser for your needs. Your adviser then contacts you for a no obligation conversation on how they can help. You decide how to proceed.

In 2022, according to the Independent Schools Council (ISC) Census, the UK average private school fee at £15,655 per year. This is an increase of 3.1% since 2021.

Yes. Many people choose to remortgage their property to pay for their children's school fees. Providing you have enough equity and pass affordability assessments, a mortgage would allow you to spread the cost of the school fees over a longer term.

The best time to start planning is as early as possible. The more time you give yourself to save, the longer you have before paying for the fees. You will have more time to put money aside and a better chance of achieving the investment growth needed.

Grandparents can pay school fees. However, it will be counted towards any gift allowances. If the gift allowance is exceeded, inheritance tax could become liable if the grandparent dies within 7 years of making the gift.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  Leicester, Leicestershire

Leicester, Leicestershire Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  No obligation consultation

No obligation consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.