If you don't plan your finance correctly for later life your family could easily find themselves with an unwanted inheritance tax bill. You may have heard to utilise the 7 year rule, but what is the 7 year rule in inheritance tax?

In this insight, we are going to set out what you need to know to make the 7 year rule work for you.

The 7-year gift rule in Inheritance tax (IHT) is an allowable exemption to inheritance tax. If a gift, above the threshold amount, has been made 7 years before death, the value of the gift is not included in IHT calculations.

Inheritance Tax is a 40% tax payable on the value of the estate that is calculated to be over the UK set thresholds. It must be paid by the end of the 6th month after the estate holder's death. If this is not possible, HMRC will begin to charge interest.

In the UK, you do not pay inheritance tax on estates that are valued at less than £350,000. This threshold can rise to £1,000,000 depending on what is included in the estate and who the beneficiaries are.

If you make a gift and pass away within 7 years, HMRC includes the gift in your estate, making it liable for Inheritance Tax to prevent tax avoidance. This rule highlights the importance of understanding the implications to avoid unintended tax burdens for your beneficiaries.

Gifts impact the nil-rate band, which is the tax-free threshold for Inheritance Tax in the UK (currently £325,000). If the gift value exceeds this threshold, the recipient may be responsible for paying tax on it.

Lack of awareness or preparation can lead to unexpected tax liabilities for your family when they inherit the estate, causing potential complications.

For instance, if a gift of £400,000 was made 2 years before death, and the estate's additional value was £100,000, the tax liability would be on the £75,000 from the gift and the additional £100,000. This scenario can leave beneficiaries unaware of the potential tax obligation tied to the gift.

In such cases, the entire nil-rate band can be consumed by the gift, leaving no tax-free allowance for the remaining estate. Gifts are prioritised in utilising the nil-rate band, highlighting the need for careful consideration and planning.

The term "gift" can be broad, so it's important to understand what falls under this category for inheritance tax purposes. Here's a breakdown of what is included:

Additionally, a gift can also encompass the value of a discount given when selling your home for less than its market value in a "discounted sale." For example, if you sell your home to your children at a 50% discount, the remaining 50% will be considered a gift.

It's worth noting that items you leave in your Will are not classified as gifts but are considered part of your estate. To avoid any confusion or unintended consequences, it's crucial to have your Will written as part of estate planning services.

Certain gifts are exempt from inheritance tax, meaning they are not taken into account when calculating the value of your estate. These exemptions include:

The allowable gift tax threshold is £3,000 per tax year. You can split this amount among different individuals as long as you don't exceed the threshold. Additionally, you can carry over any unused portion of your annual gift allowance for one additional tax year.

You can give small gifts of up to £250 as many times as you like, as long as they are not given to the same individuals who have already received anything under the £3,000 annual allowance.

Birthday or Christmas gifts are exempt from inheritance tax if they are paid for using regular income.

Each tax year, you can make specific gifts for weddings or the start of a Civil Partnership. The allowances are as follows:

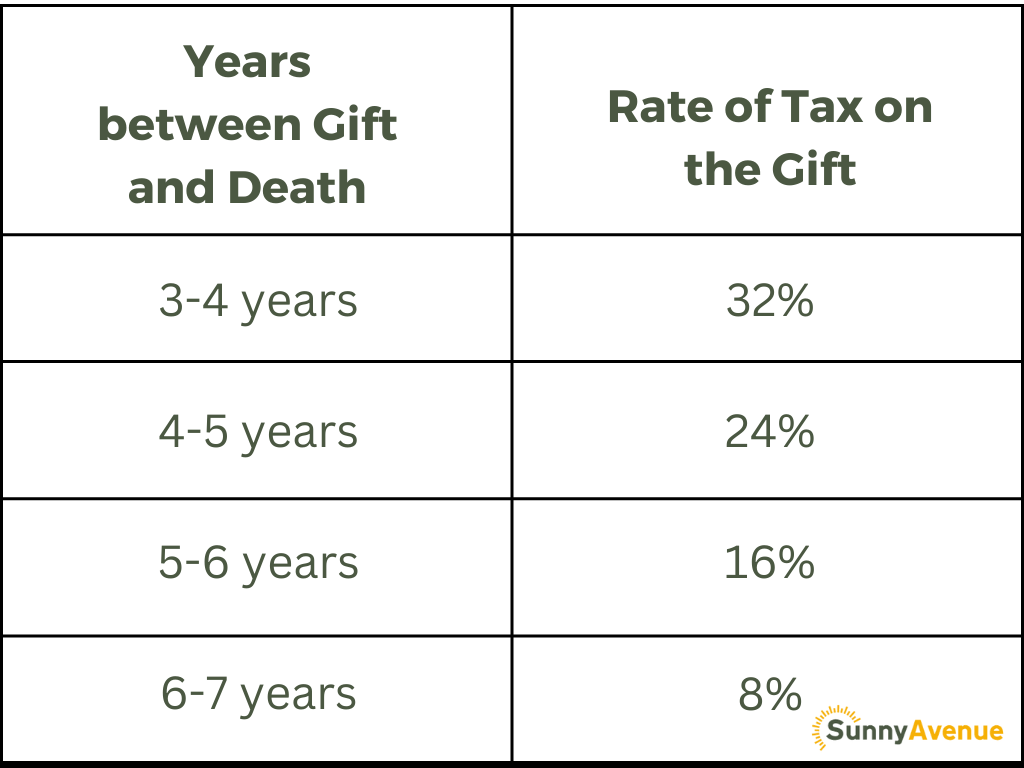

The amount of inheritance tax you pay when you die within the 7-year period depends on when the gift was made and the time elapsed since your passing. This system is referred to as Taper Relief, where the tax payable decreases the further away the gift was made from the date of death. The amount of tax is tiered based on a specific rate.

Here is a table outlining the tax rates based on the number of years between the gift date and death:

If a gift of £400,000 was made four years before death, it would utilise the full nil-band allowance. An amount of £75,000 would be subject to Inheritance Tax (IHT).

Calculation: £75,000 * 24% = £18,000

If death occurs in the second year after making the gift, the Inheritance Tax due would be calculated as follows:

Calculation: £75,000 * 40% = £30,000

In Example 1, £75,000 would be liable for IHT and the tax rate applied would be 24%. Therefore, the Inheritance Tax payable would amount to £18,000.

In Example 2, the same £75,000 would be subject to IHT, but if death occurs in the second year, the tax rate would be the full rate of 40%, resulting in an Inheritance Tax liability of £30,000.

The 7-year inheritance tax gift rule also applies to property. If a property is gifted seven years before death, it will be exempt from tax. However, if death occurs within 7 years of gifting the property, taper relief will be applied. If the property is partially gifted, such as in a discounted sale, there may be a tax liability. The recipient of the gift will be responsible for paying the taper relief based on the difference between the market value at the time of gifting and the discounted value.

Let's consider the case of Mr. A selling his property to Mr. B at a discounted price. The market value of the property is £500,000, but it is sold to Mr. B for £300,000, at a discounted rate. If Mr. A passes away, the difference between the market value at the time of gifting (£500,000) and the discounted value (£300,000) is considered the gift amount, which in this case is £200,000. Mr. B would be liable for paying the relevant tax on this gift amount. If Mr. A survives for 7 years after the date of the gift, no Inheritance Tax (IHT) would be due.

Inheritance tax planning involves discussing your needs and preparing for expected tax liabilities. A Financial Adviser or Later-life adviser can help you by putting a plan together to ensure you can take advantage of the allowances and follow the rules, such as the 7 year exemption rule, or purchasing a gift inter vivos policy.

Estate planning services work similarly, but they also offer other estate-related services, such as the execution of your wishes from your Will when you pass away.

Speaking with a Financial adviser is a good idea. They will be able to assess how much money you will have left for retirement and recommend if you are better off using a Trust to make a gift instead.

Source:

So, what is the 7 year rule in inheritance tax? It's one of the many ways you can avoid paying inheritance tax in later life. To get started with inheritance tax planning complete the Sunny Fact Find. The answers you provide help us to find the best-suited adviser for your needs. Your adviser then contacts you to discuss how they can help, you decide how to proceed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

£51,000+

£51,000+  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Kirkby Stephen, Cumbria

Kirkby Stephen, Cumbria Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  Leicester, Leicestershire

Leicester, Leicestershire Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

£101,000+

£101,000+  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.