Welcome to the Avocado:House Deposit Index - a comprehensive study that delves into the captivating relationship between avocado prices and the challenge of saving for a house deposit in the UK over the last two decades.

Our mission with this research is to provide valuable insights into the complexities of the housing market and offer practical strategies for prospective homebuyers.

As the avocado craze took the world by storm, a common narrative emerged, suggesting that cutting out avocados could be the secret to financial success in the quest for homeownership. However, this study aims to challenge this notion by examining meticulously gathered data from the Office of National Statistics, unveiling a more nuanced and intriguing picture.

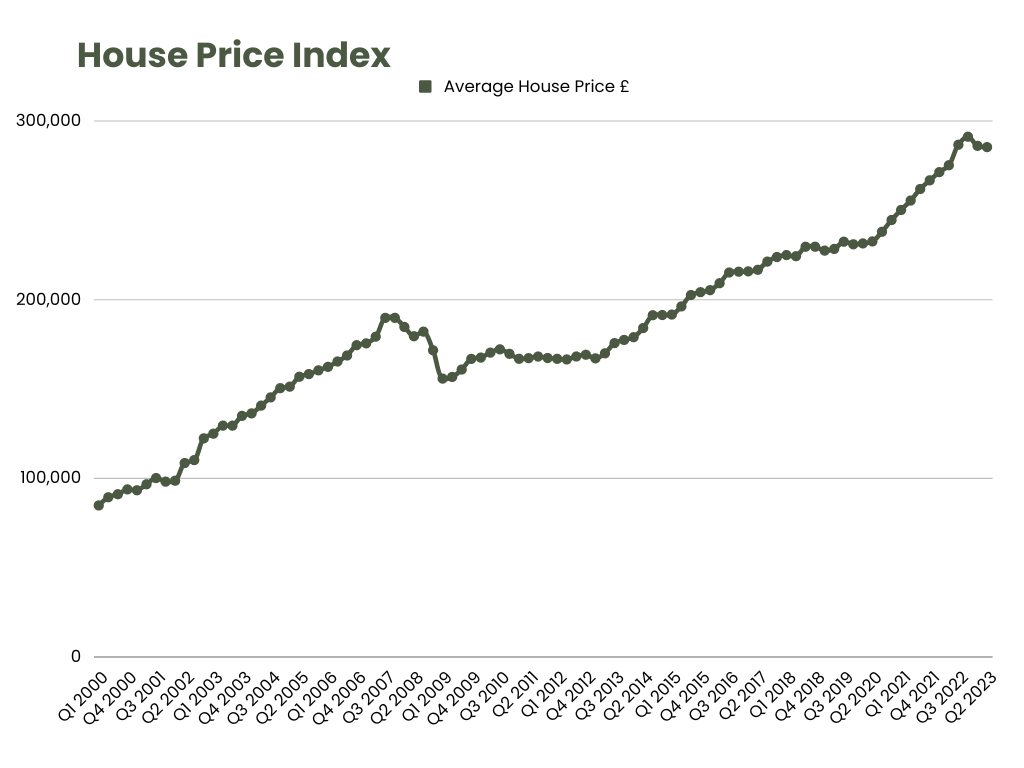

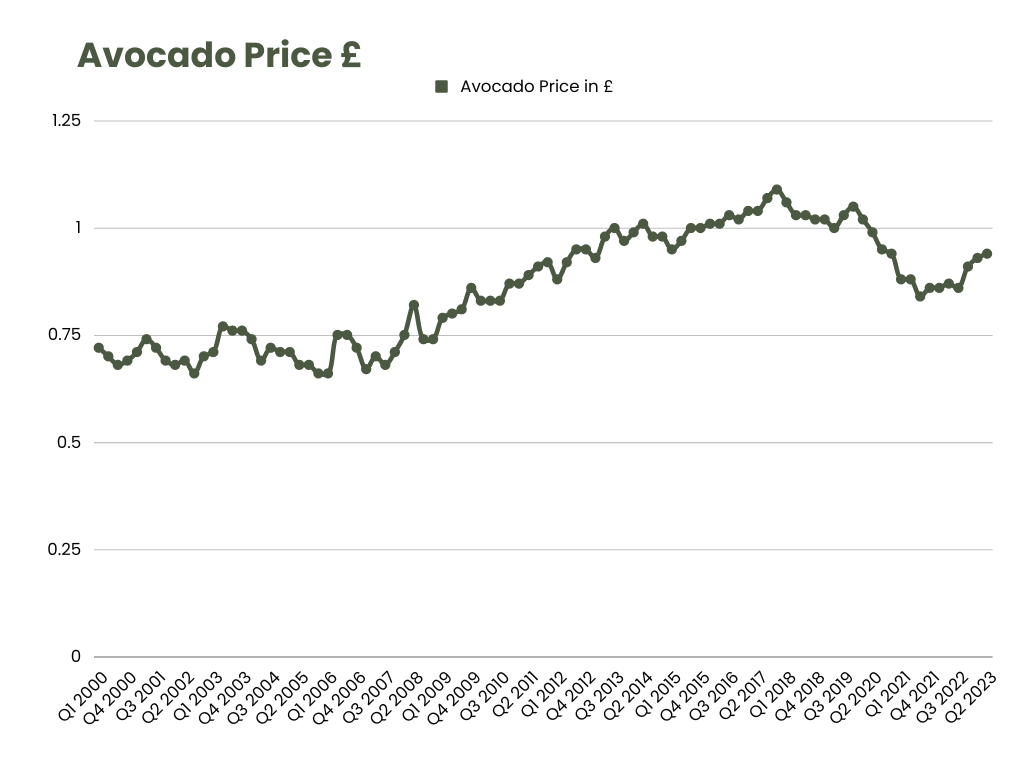

Throughout the following pages, we will analyse the fluctuations in avocado prices alongside average house prices and the corresponding amount needed for a 10% house deposit. Our journey begins with the early 2000s, where we observe intriguing synchronicities between avocado prices and house deposits, leading up to the tumultuous times of the 2008 financial crisis, and beyond.

As we progress, it becomes evident that the avocado-housing relationship is more complex than a simple cause-and-effect scenario. We hope to foster a deeper understanding of the factors influencing the ability to save for a deposit and offer insights that empower aspiring homeowners to make informed decisions.

So, grab your favourite avocado toast and join us as we unveil the untold story of the Avocado:House Deposit Index and explore how financial planning and housing policies play pivotal roles in the journey to owning a home in the UK.

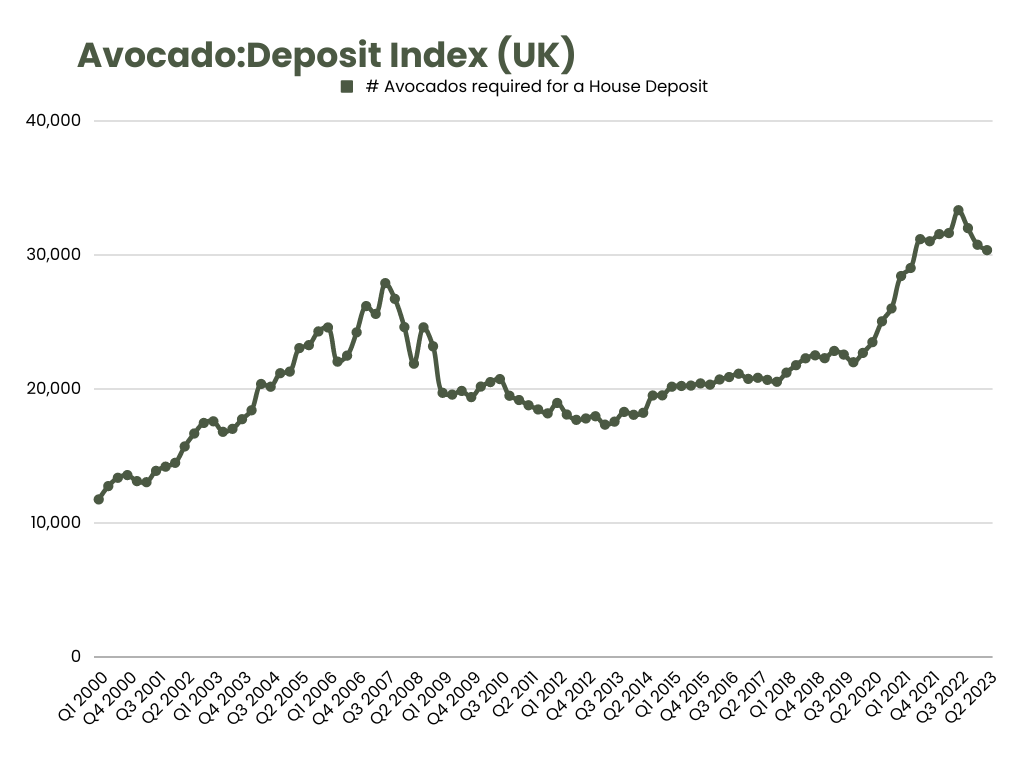

According to the Sunny Avenue Avocado House Deposit Index, in 2023, the number of avocados required to not be consumed but instead use the money for a house deposit is 30,357 avocados. This number takes into account avocado inflation alongside the house price index.

Here are some key highlights from the Avocado:House Deposit Index:

Quarter by quarter, we witnessed how avocado prices and house deposits seemed to move in sync, with fluctuations reflecting each other. In Q1 2000, an average house deposit of £8,462 would have required approximately 11,753 avocados.

The period leading up to the 2008 financial crisis saw notable changes in the Avocado:House Deposit Index. As avocado prices remained relatively stable, housing prices experienced a significant surge, leading to larger numbers of avocados needed to cover a deposit.

After the financial crisis, both avocado and housing prices experienced a correction, leading to a gradual decline in the number of avocados required for a deposit.

Between 2016 and 2020, the index displayed an intriguing inverse trend. As avocado prices fluctuated, house prices continued to climb, making it increasingly challenging to save for a deposit.

In the most recent quarters, the Avocado:House Deposit Index shows that while avocado prices have stabilised, house prices have remained on an upward trajectory, putting pressure on aspiring homeowners. Until most recently when the index starts to fall from an all time high as a result of the beginning of falling house prices.

This research highlights that cutting out avocado consumption alone may not be the answer to saving for a deposit after all. One avocado a day costs around £343 per year. Saving for a deposit averaging £28,535 would take approximately 30,390 days, which is about 83 years. Showing the need for broader financial planning and affordable housing policies.

As house prices have increased at a faster pace than the price of Avocados, this data shows the avocado-house deposit gap is widening, making it increasingly challenging to save for a deposit by giving up avocados alone.

In conclusion, the Avocado:House Deposit Index has uncovered valuable insights that challenge the popular notion of avocados being the primary obstacle to saving for a house deposit. While it's true that small daily expenses can add up over time, focusing solely on cutting out avocado consumption will not be enough to achieve the goal of homeownership. Instead, we advocate for a comprehensive approach to financial planning and prudent spending habits.

Here are some key takeaways and recommendations for aspiring homeowners:

Saving for a house deposit requires a well-rounded financial strategy. Start by creating a budget that outlines your income, expenses, and savings goals. Identify areas where you can cut back on non-essential spending and allocate those funds towards your deposit savings.

While the prospect of homeownership is exciting, setting realistic deposit goals is crucial. The average deposit for a home can vary significantly depending on the region. Understanding the housing market in your area and setting achievable targets will make the process less daunting.

Investigate various government schemes and incentives designed to assist first-time homebuyers. These programs may offer financial assistance, reduced deposit requirements, or favourable mortgage rates.

Explore different investment avenues that could potentially grow your savings faster than traditional savings accounts. However, ensure you understand the associated risks and seek professional advice if needed.

Don't hesitate to negotiate house prices with sellers or developers. In some cases, a modest reduction in the house price can lead to a more manageable deposit amount.

If the property market in your area is particularly challenging, consider shared ownership schemes. These programs allow you to purchase a portion of the property and pay rent on the remaining share, making homeownership more accessible.

Keep abreast of changes in housing policies and regulations that may impact the property market. Staying informed can help you adapt your financial plans accordingly.

If you find it challenging to navigate the complexities of saving for a house deposit, consider seeking advice from a qualified financial or mortgage adviser. They can help tailor a plan that suits your individual circumstances.

Ultimately, the Avocado:House Deposit Index reminds us that achieving homeownership requires a combination of discipline, perseverance, and financial awareness. By adopting prudent spending habits and embracing a comprehensive financial plan, you can be well on your way to making your dream of owning a home in the UK a reality.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.