If you're considering how you can get onto the property ladder, one thought you may have is whether you can raise some borrowing power with a bit of help from your family. A common thought had by clients, is, can I get a mortgage with my parents?

Well, the good news is yes you can. However, it's not that straightforward.

In this insight, we discuss how Mum and Dad can potentially help you find your first home.

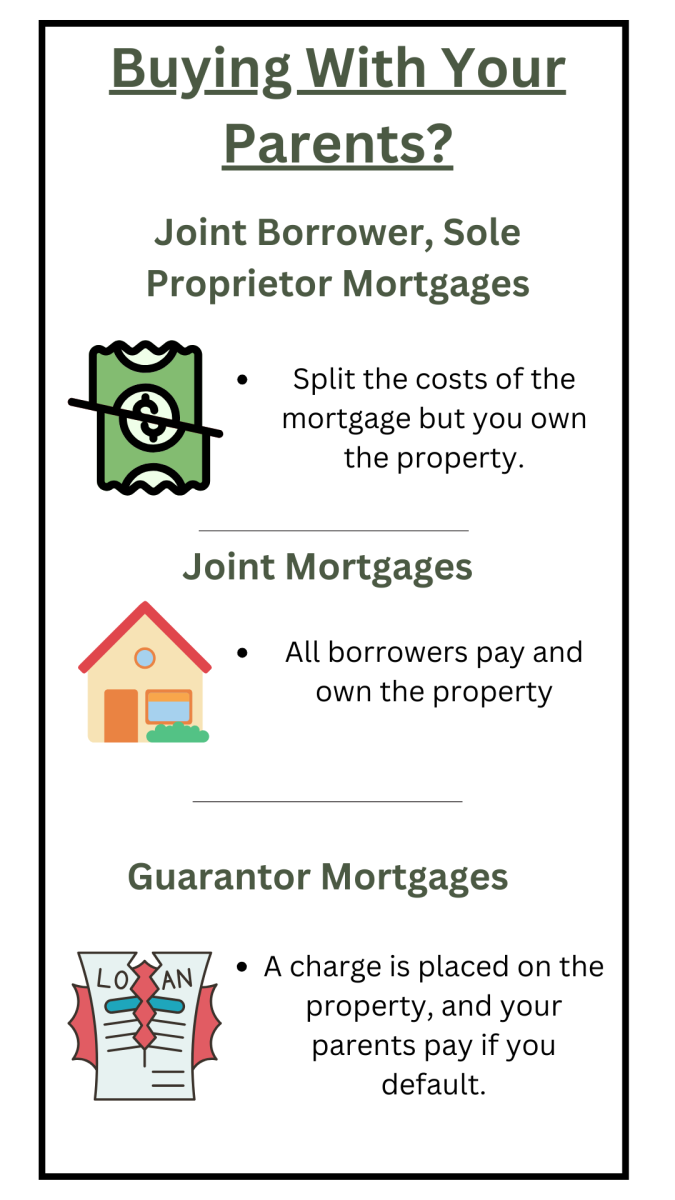

Yes, you can get a mortgage with your parents by using a joint borrower sole proprietor mortgage. This mortgage combines your affordability power with your parents while you legally own the property. Other options include joint and guarantor mortgages.

This arrangement is particularly beneficial for those who may struggle to meet the income requirements of a mortgage on their own. Typically, up to four individuals can participate in a Joint Borrower Sole Proprietor Mortgage, but it's crucial to note that all applicants are legally responsible for ensuring the mortgage is paid, regardless of the ownership status.

There are a couple of options to consider when getting a mortgage with your parents, seeking advice is the best solution to understanding how each mortgage option can impact you and your family.

These options include:

With a joint borrower sole proprietor mortgage, you and your parents can share mortgage costs, even though you alone legally own the property. This helps those with variable incomes or self-employed individuals struggling with traditional lending criteria.

JBSP mortgage borrowing capacity combines all borrowers' incomes, often multiplied by a factor like 4.5, enabling a larger loan than solo applications.

Age limits for JBSP mortgages vary; most have a 70-year limit, but some extend it to 80 or 85. If you can't pay, your parents share payment responsibility.

In a joint mortgage, several buyers purchase a property together, share mortgage responsibilities, and jointly own the property. In contrast, a JBSP mortgage lets multiple applicants share the mortgage obligation while maintaining sole ownership, ensuring one person has complete control and decision-making authority.

All applicants on the application must meet lending criteria and share responsibility for mortgage payments. If one applicant defaults, others assume the responsibility. Also, all applicants on the deed legally claim ownership as specified in the agreement.

In a guarantor mortgage, a third party (often a close relative) commits to covering mortgage payments when the primary borrower defaults. Unlike JBSP mortgages, guarantors typically intervene only if a debt arises, whereas in a JBSP setup, they contribute from the start.

A charge is placed on the guarantor's house, meaning that if the borrower defaults and parents can't make repayments, their home may face repossession. Some guarantor options offer 100% mortgages, aiding children who struggle to save by allowing them to secure a mortgage without a deposit.

Parents assisting their children in entering the property market can explore various mortgage options. These include gifted deposits, lending money, guarantor mortgages, and family offset mortgages, tailored to individual needs and preferences.

Gifting a deposit can be a straightforward way for parents to help their child buy a home. This involves transferring a sum of money from parent to child, which forms part or all of the deposit. A gifted deposit should come with no obligation to repay, and parents may be required to sign a waiver to confirm this arrangement.

If parents are unable or unwilling to gift money, they can consider lending the sum to their child to help with the deposit or other associated costs. Although no interest is charged on this loan, mortgage providers treat it as a loan, which may impact affordability assessments and borrowing capacity. A parent-child loan can be a viable option if the child is struggling to save for a deposit, but careful consideration should be given to affordability.

A family offset mortgage allows parents to offset the value of their savings against their child's mortgage. This reduces the amount of interest the child has to pay on the mortgage. The savings are locked away for a period of time, typically until the child has paid off around 25-30% of their mortgage.

This option is suitable for parents who want to save their child money without permanently giving funds away. Family offset mortgages come with fewer risks compared to other family mortgage products.

While there are advantages to buying a house with parents, there are also potential disadvantages that should be considered. These include financial risks and liability, tax implications, and maximum age caps on mortgage terms.

When you have a joint mortgage, your credit reports are tied together until the loan is fully paid off. If one person has a poor credit score, it could make it harder to get approved, and it might impact the other person's future financial requests once your reports are linked. Plus, if one person falls behind on payments and parents can't cover the full amount, the mortgage provider can take possession of other properties owned by the parents.

First-time buyers in England, Wales, and Northern Ireland are exempt from paying stamp duty on purchases below £300,000. However, when parents aren't first-time buyers and already own a property, there's no first-time buyer discount for a joint purchase. Instead, a 3% surcharge on the standard stamp duty rate applies to the second home. If the property is later sold at a profit, capital gains tax may also be due if it's considered a second home for the parents.

Many lenders impose an age limit on mortgage terms, often between 65 and 85. If parents surpass this limit, the mortgage term may have to be shortened, leading to higher monthly payments.

It's crucial to ensure that the higher payments are manageable. However, some specialized lenders focusing on later-life lending may offer more flexibility with age limits, permitting individuals in their 70s or 80s to secure a mortgage.

Mortgage providers also have minimum income requirements as part of their affordability criteria. If parents are approaching retirement age or are already retired during the mortgage term, this could pose a challenge.

Lenders may impose a maximum age cap or require parents to prove that their pension income or other sources are sufficient to cover the repayments. However, if parents can demonstrate affordability, there are still options available, and being retired may even make it easier to prove income stability.

Yes, your parents can give you money to help you buy a house. This is often done through a financial gift, and it's a common way for parents to assist their children in purchasing a home.

There's no maximum limit to the amount your parents can gift you for a house, but be aware of potential gift tax implications, as specific regulations vary by location. Consult with tax professionals for guidance.

Buying a house with parents can be a viable option for young people looking to overcome financial barriers in homeownership. However, it is essential to carefully consider the pros and cons, lender expectations, and alternative family mortgage options.

The next steps, talk to a mortgage adviser, discuss your income, and find out how best to proceed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.