There is a lot of work involved with arranging Limited Company Buy to Lets, it's a tough choice. Should you go down the buy to let through a limited company route, or buy to let through a personal name?

Many property investors don't rely on rental income to support their finances. In such cases, structuring the buy-to-let property within a limited company can offer significant advantages, allowing for more flexibility in managing funds before being subject to higher tax rates of 40-45%. This is one reason why purchasing through a limited company has seen a remarkable 150% increase in popularity in 2022.

In this insight, we will cover what you need to know about limited company buy to lets and how to get started.

Limited company buy-to-lets refer to properties that are purchased and owned by a limited company rather than an individual. In this case, the limited company acts as the landlord and manages the property for rental purposes. This structure is often chosen by property investors as it offers certain tax advantages.

Limited company buy-to-let mortgages have gained popularity in recent years due to the potential for reduced tax liabilities and increased financial control.

Limited company buy-to-let mortgages offer distinct differences compared to personal buy-to-let mortgages. Firstly, you require a specialist lender who caters specifically to limited company borrowing. Secondly, the criteria and assessment for lending are unique in this scenario.

With limited company buy-to-let mortgages, you borrow funds to purchase the property under the ownership of the limited company. The directors of the company own shares within it, which grants them ownership of the property. The limited company structure can be established as a standard company or as a Special Purpose Vehicle (SPV). When evaluating your application, lenders consider the following factors to determine its acceptability:

The lender will assess the deposit you have available for the property purchase.

Lenders may require personal guarantees from all directors of the limited company.

The estimated rental income of the property will be evaluated in comparison to the projected mortgage repayments.

Your current portfolio size and experience in the buy-to-let market will be considered.

The type of property you are planning to purchase will also be taken into account during the assessment.

No, it is now common for limited company buy-to-let applications to be processed within the same timeframe as personal buy-to-let applications. In the past, there may have been delays due to lenders adapting to the increased use of limited companies by investors. However, with the growing popularity of limited company buy-to-lets, lenders have streamlined their processes. New special purpose vehicle (SPV) limited companies usually have faster processing times as background checks are only conducted on the directors. Established limited companies may take slightly longer as checks are done on both the directors and the company.

One common factor is the post-offer legal work. Some lenders do not permit solicitors to act on a dual representation basis, which means involving multiple solicitors can slow down the process.

Another factor is obtaining personal guarantees. Most lenders require personal guarantees for limited company buy-to-lets, which can take time to arrange. Directors and majority shareholders are typically required to provide these guarantees.

A Special Purpose Vehicle (SPV) is a company specifically created for the purpose of property acquisition or investment. It serves as a separate entity, distinct from personal or other company assets. Investors often choose SPVs due to their tax advantages and the possibility of joint ownership.

When applying for a Buy to Let Mortgage using an SPV, only the directors undergo background checks. In the case of an established Limited Company, background checks extend to the entire business and its financial aspects, which can lengthen the application-to-completion timeline.

There are a few clear benefits to be aware of when buying a buy to let through a limited company:

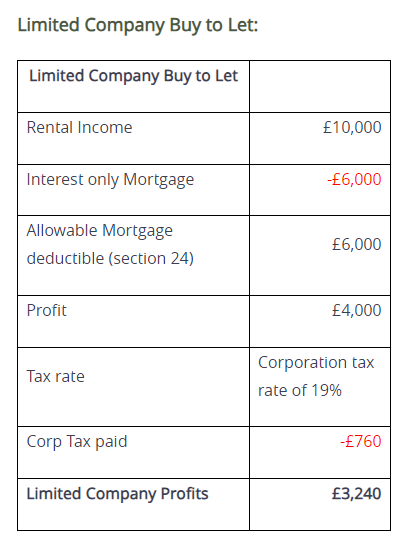

With a limited company buy to let business, the income is received by the company, subject to corporation tax. In contrast, personal buy to let income must be declared for personal income tax, potentially incurring higher tax rates. Corporation tax is currently 19%, and even with the upcoming increase to 25% in April 2023, small profits (up to £50,000) can still be taxed at 19%. This can make a limited company a more cost-effective option from a tax perspective, especially if you don't intend to withdraw from the company.

Limited companies can deduct their full mortgage costs for tax purposes, while individuals can only claim back the interest on their mortgage up to a maximum of 20% of the rental income. This difference is due to Section 24, which applies to personal buy to lets but not to limited companies. By declaring larger deductibles, limited companies can have smaller taxable profits and pay less tax.

Owning properties through a limited company offers flexibility for future property ownership transfers. By changing the shareholding of the business, property ownership can be transferred without incurring full stamp duty land tax rates and potential surcharges. Instead, the new owners only pay the 0.5% stamp duty rate for buying shares, potentially saving thousands of pounds in stamp duty costs.

Opting for a limited company buy to let can provide tax advantages, greater deductibility, and future planning flexibility, making it an appealing choice for property investors.

When deciding whether buying through a limited company is the right choice for you, it's important to take the following factors into consideration:

Buying through a limited company incurs additional costs such as conveyancing fees and professional services like accounting. These costs should be factored into your budget. However, it's worth noting that these expenses can be deducted for tax purposes within a limited company.

Mortgage rates for limited company buy to lets are typically higher compared to personal buy to let mortgages. However, you still have the option to buy on an interest-only basis if needed.

Lenders often require personal guarantees from directors, which means your personal assets could be at risk if the company defaults on the mortgage. It's important to carefully consider the potential implications of providing personal guarantees.

If you are currently paying higher-rate tax, using a limited company can offer significant tax savings. Corporation tax is 19% for rental profits below £50,000 and 25% for profits above that threshold.

If you have plans to grow your property portfolio quickly, a limited company structure may be advantageous. With lower tax rates, you can reinvest profits back into the company, allowing for faster portfolio expansion.

When evaluating whether to pursue a limited company buy to let, it's crucial to weigh these considerations against your financial goals, tax situation, and long-term investment strategy.

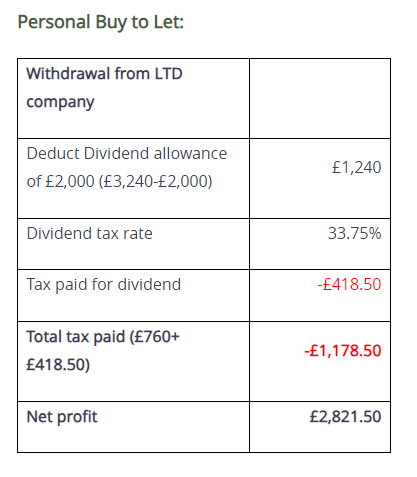

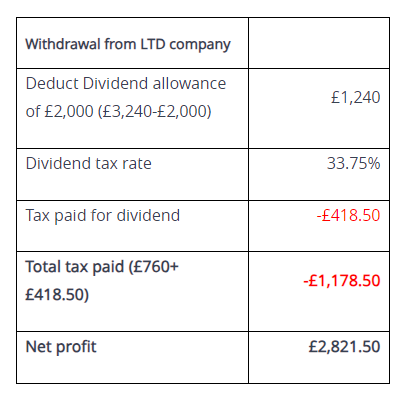

When you need to withdraw cash from the limited company, there are tax implications to consider. Not only will you need to pay corporation tax on the company's profits, but you'll also be subject to income tax on any dividends you take out. Currently, there is a tax-free dividend allowance of £2,000. Beyond that, the tax rates for dividends are 8.75% for basic rate taxpayers, 33.75% for higher-rate taxpayers, and 39.35% for additional-rate taxpayers.

It's important to note that the example provided here is for illustrative purposes only and does not provide a definitive answer on which option is the best. The numbers used are variables that can significantly impact the outcome, making it essential to seek professional tax advice before making a decision. The most cost-effective approach can vary depending on individual circumstances.

In this scenario, let's assume the landlord is a higher-rate taxpayer, paying 40%, and the limited company has a corporate tax rate of 19%. The corporate tax rate remains at 19% for profits below £50,000.

Please remember that tax rules and rates can change over time, and personal circumstances may vary. Seeking guidance from a tax professional will ensure you have the most accurate and up-to-date information tailored to your specific situation.

If you are looking for more information on Limited Company Buy to Lets, complete the Sunny Fact Find. The answers you provide help us to find the best-suited adviser for your needs. Your adviser contacts you to discuss how they can help, you decide how to proceed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Cheltenham, Gloucestershire

Cheltenham, Gloucestershire No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.