Buying a property is an exciting experience. But with the excitement comes a lot of paperwork and tax information that can be overwhelming and confusing. One of the most important taxes to understand is the Second Home Stamp Duty and its surcharge.

Stamp Duty Surcharge is a tax in the UK imposed on the transfer of land, property, or shares. It’s also known as Stamp Duty Land Tax or SDLT for short. The tax is based on the value of the property being purchased, and the amount varies depending on the property’s value.

In this insight, we’ll explain everything you need to know about the Stamp Duty Surcharge, including what it is, how much it is, when it applies, how to calculate it and pay it.

The Second Home Stamp Duty is a stamp duty surcharge. An additional tax rate needs to be paid when purchasing an additional or second property. If your transaction results in you buying an additional property to the one you have, you will need to pay the surcharge.

The surcharge amount you pay is a percentage of the value of the property you are buying. Stamp duty is only payable by the buyer of the property.

On the 1st April 2016, the second home stamp duty surcharge was introduced to slow down house price growth and prevent houses from being snapped up by Buy to Let landlords. It was mainly introduced to help control the housing market.

If you are buying an additional property you need to pay a surcharged rate of stamp duty. If at the end of the transaction, you own 2 or more houses and have not replaced your main residence, the higher rate of stamp duty will apply. It only applies to buying a property in England.

The surcharge rate is currently set at 3%. Your total stamp duty is calculated as the 3% surcharge plus the normal rate of stamp duty you would pay for the value of the property you are purchasing. The normal rate of stamp duty you pay will depend on whether you are a first-time buyer, what part of England you are buying, and the purchase price of the property.

If you own the home you live in and purchase a Buy to Let property for £300,000. You will need to pay the regular stamp duty plus the surcharge.

This would be equal to 5% above £250,000 and an additional 3% surcharge across the full £300,000.

£50,000*5%=£2,500.00 + £300,000*3%=£9,000.00

Total SDLT = £11,500.

After completing your purchase you have 14 days to complete a stamp duty tax return form and pay any stamp duty outstanding. Most of the time, your conveyancer will pay your stamp duty from the money on completion and this would have been accounted for as part of their invoice.

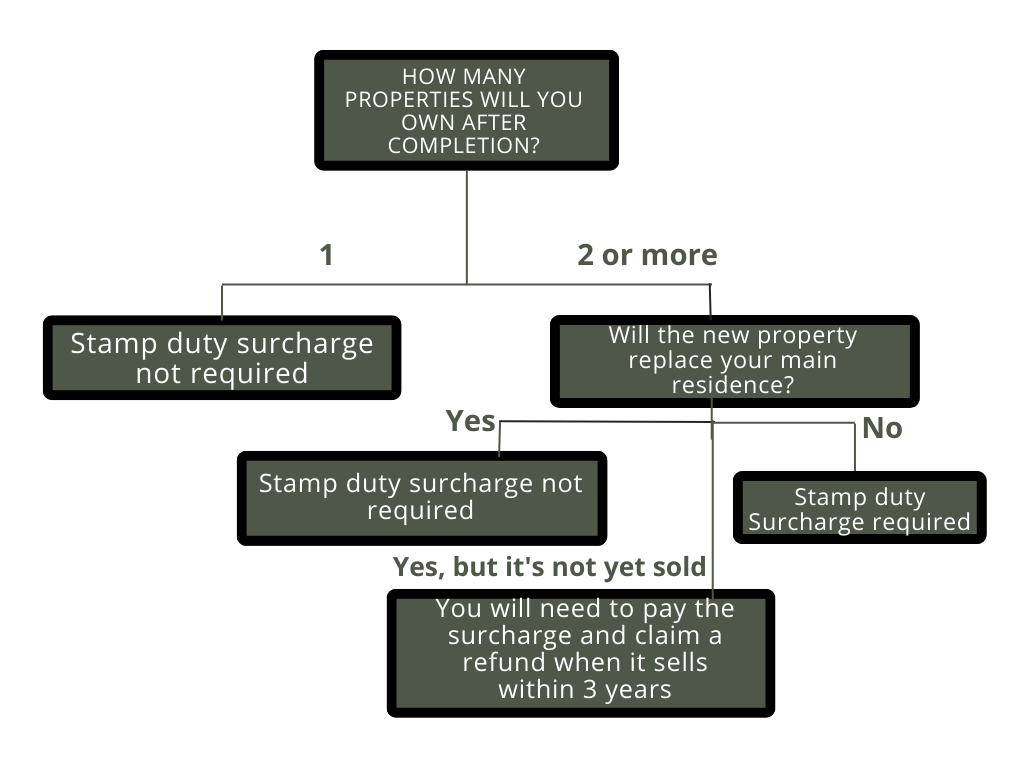

The stamp duty surcharge rules can be confusing and there is a lot of misinformation out there. We have put together a common scenario flow chart to help to see whether you need to pay the stamp duty surcharge or not.

No. If you are replacing your main residence on the same day that you buy your new property, you do not have to pay the surcharge.

It is often the case that people may already own a Buy to Let property and be looking to upsize their main residence. This scenario does not require the surcharge to be paid.

You have up to 3 years to sell the property, and if you do you can obtain a refund from HMRC. However, you will need to pay the additional stamp duty surcharge upfront. This can create cash flow issues as you will need to account for finding the extra 3% before you can complete.

If as a couple, you already own a property each, you will be treated as one person. If you decide to buy together you will need to pay the stamp duty surcharge unless you choose to sell both properties. This is because even if you replace a main residence, at the end of the transaction you will still own two or more properties.

For more information on the stamp duty surcharge, you can read the gov.uk guidelines here

Stamp duty Land Tax is a tax payable when purchasing a property in England. If you are buying in Scotland or Wales you pay land & buildings tax or Land transaction tax respectively. Calculators are available to help you see how much you would need to pay:

If you're unsure about the second home stamp duty, moving home, or buying a second property. Consider seeking mortgage advice. If you're unsure where to start, complete the Sunny Fact Find. The information you provide helps us to find the best-suited adviser for your needs. Your adviser contacts you for a no-obligation chat on how they can help. You decide how to proceed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Cheltenham, Gloucestershire

Cheltenham, Gloucestershire No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.