Your debit card is more than just a plastic ticket to financial transactions. It's a powerful tool, bearing a unique set of information crucial for your financial dealings both online and offline.

Amongst this information, the card number holds significant importance. For those asking, "where is the card number on a debit card?", you've come to the right place!

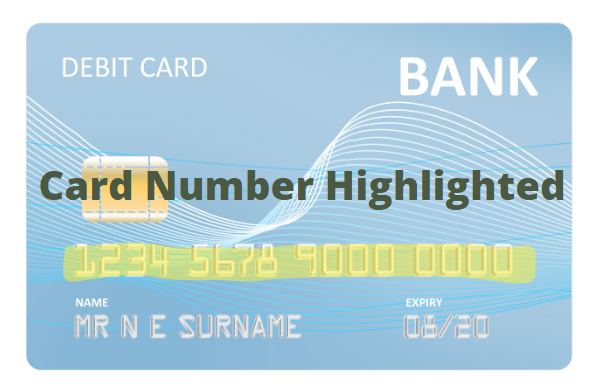

On a debit card, the card number is typically printed on the front of the card. It is a 16-digit number that is usually divided into four groups of four digits each. The card number is a crucial piece of information required for making online or over-the-phone transactions.

Here is an example of how the card number might be displayed on a debit card:

'1234 5678 9012 3456'

Please note that this is just a generic representation, and the actual arrangement and design of the card number might vary depending on the card issuer. Always keep your debit card secure and avoid sharing this information with anyone you don't trust.

★★★★★ 4.5

Your debit card number, often referred to as a PAN (Primary Account Number), is a string of 16 digits embossed or printed on the face of your card. This number is unique to your card, acting as a digital fingerprint in the financial world.

The term "PAN" in the context of debit cards stands for "Primary Account Number." It is another name for the card number or the 16-digit number that uniquely identifies a debit card. PAN is an acronym used in the payment card industry to refer to the card number, and it is often used interchangeably with the term "card number."

The PAN is a crucial piece of information required for various debit card transactions, such as online purchases, point-of-sale transactions, and ATM withdrawals. It is essential to keep your debit card's PAN confidential and secure to prevent unauthorised use or potential fraud.

Your debit card number is an essential piece of information for completing any financial transaction. It tells the bank which account to deduct funds from when conducting a transaction. In essence, it's the key that unlocks your bank account for any debit transactions.

A debit card number is used in various ways for different types of transactions. When you use a debit card, the card number plays a central role in the payment process. Here's how a debit card number is typically used:

In-Person Transactions: When making a purchase at a physical store or merchant, you can use your debit card to pay. The merchant will have a card reader or a point-of-sale (POS) terminal where you insert, swipe, or tap your debit card. The card number is read electronically from the card's magnetic stripe or chip, and the transaction is processed through the card network.

Online Transactions: For online purchases, you usually need to enter your debit card number during the checkout process on the merchant's website. You also need to provide additional information like the card's expiration date, CVV (Card Verification Value) or CVC (Card Verification Code) – a three-digit security code found on the back of the card, and sometimes other security measures like One-Time Passwords (OTP) for added verification.

Phone or Mail Orders: If you make purchases over the phone or through mail-order services, you may need to provide your debit card number, expiration date, and CVV/CVC to the merchant for payment.

ATM Withdrawals: When you withdraw cash from an ATM using your debit card, you are required to enter your card number, and in some cases, your PIN (Personal Identification Number) for authentication.

Contactless Payments: Some debit cards support contactless payments, where you can simply tap your card on a contactless-enabled payment terminal to make a transaction. The card number is securely transmitted via the card's embedded chip or wireless technology.

Recurring Payments: If you have set up automatic bill payments, subscription services, or other recurring transactions, your debit card number will be stored securely by the merchant or payment processor to facilitate these payments.

Understanding the anatomy of a debit card number can shed light on its significance and how it is used in the payment process.

The first six digits of a debit card number are known as the Issuer Identification Number or IIN. These digits serve a crucial purpose, as they identify the card's issuing institution or network. Different card issuers, such as banks or financial institutions, are assigned specific IINs, making it possible to recognise the card's origin. This information is vital for routing the transaction through the appropriate network and ensuring seamless communication between the merchant, cardholder's bank, and the card issuer.

Following the IIN, the next nine digits form the Individual Account Identifier. These numbers hold unique information about the individual account associated with the card. They help establish a link between the card and the specific account it is tied to within the issuing institution's database. The Individual Account Identifier enables the card issuer to identify the cardholder's account and process transactions accurately, deducting the appropriate funds from the correct account.

The last digit of the debit card number is known as the Check Digit. This digit serves as a form of error detection and validation. It is calculated using a specific algorithm known as the Luhn algorithm (also called the "modulus 10" or "mod 10" algorithm). The purpose of the Check Digit is to verify the accuracy of the entire card number. When a transaction is processed, the receiving system performs the Luhn algorithm calculation on the entered card number, including the Check Digit. If the resulting value matches the Check Digit, it indicates that the card number is likely valid and free of any common input errors. This verification step helps reduce the risk of accidental or deliberate errors during transactions.

Alongside your debit card number, another crucial number is the CVV (Card Verification Value) number. This three-digit number located on the back of your card on the signature strip is vital for online transactions. It adds an extra layer of security, ensuring the physical presence of the card during the transaction.

When using your debit card online, ensure you're on a secure website before inputting your card details. Look for a padlock symbol in the address bar, and the 'https' prefix in the URL.

Knowing where the card number on a debit card is, along with understanding its function, is crucial for everyone in today's digital age. It's not just about having a card, but knowing how to use it securely and efficiently. Stay safe and make the most out of your financial freedom with your debit card.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.