The impact of interest rate rises on individuals' moving plans has become a topic of significant concern in the UK property market. In a recent survey conducted by Sunny Avenue, we explored this issue, gathering insights from a diverse group of respondents. In this insight, we will delve into the survey findings and shed light on the reasons behind the postponement of moving plans, as well as the resilience of the property market during uncertain times. We will also include commentary from Stuart Crispe, the founder of Sunny Avenue, to provide expert analysis and perspective.

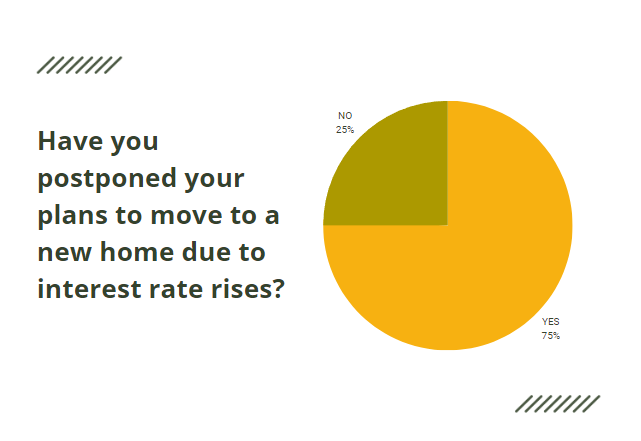

According to the survey results, a striking 75% of respondents looking to move have delayed their plans due to interest rate rises. This finding underscores the impact of fluctuations in interest rates on the decision-making process of homebuyers and sellers. However, it's essential to note that despite the uncertainty, the property market in the UK remains resilient and continues to provide opportunities for homebuyers.

25% of the sample confirmed they had plans to move but have since delayed those plans due to uncertainty around interest rate rises.

Interest rate rises have a direct impact on mortgage repayments. When interest rates increase, it typically leads to higher borrowing costs for homeowners with variable-rate mortgages or those whose fixed-rate mortgages are up for renewal.

Variable Rate Mortgages will increase around £12 a month (£150 per year), for every .25% increase in the BOE base rate.

Stuart Crispe, founder of www.sunnyavenue.co.uk: "In many scenarios, those who wished to move to upsize, simply cannot afford to do so now. Many homeowners will be questioning whether upsizing is the best option for them at the current time. Some homeowners will consider moving to less expensive towns, or even waiting and hoping for Interest Rates to fall".

Homeowners could potentially be looking at ways to either reduce the cost of moving home or find better value in the market. Sunny Avenue considered some of the possible alternatives and put the options to the people to check the most likely.

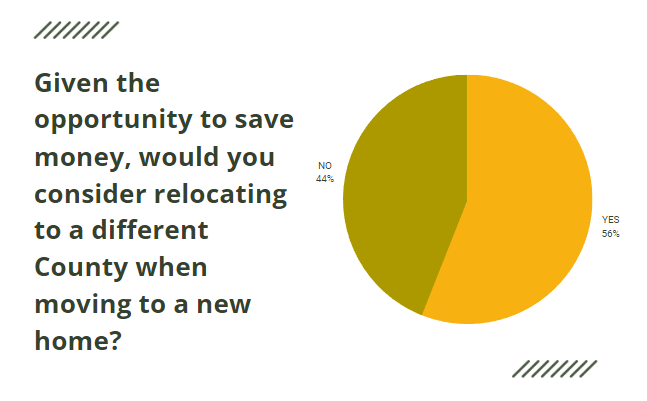

With the rise of remote work opportunities, the necessity of living near the city has diminished for many individuals. This newfound flexibility has opened doors for people to explore new counties, seeking better value for their hard-earned money. At Sunny Avenue, we conducted a survey to gauge the willingness of our sample to consider relocating to different counties in order to save money on property. The results shed light on an intriguing trend of homebuyers seeking both affordability and new experiences in their quest for the perfect home.

44% of the sampled audience confirmed they would not consider relocating to a new county to save money, whilst an impressive 56% demonstrated no loyalty when it comes to saving money.

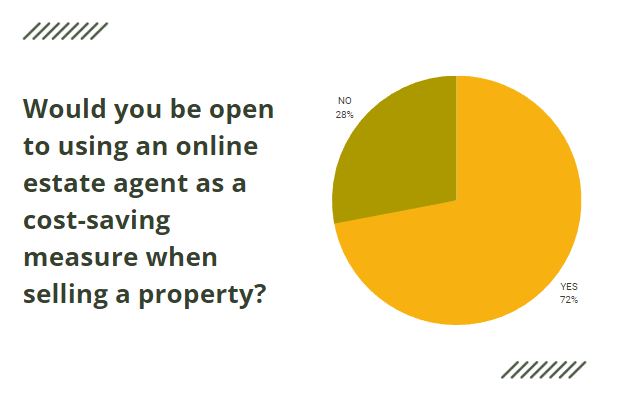

Online estate agents rocked the estate agency market by charging a fixed up-front fee for their services, instead of the traditional percentage of the sale value. This approach saves sellers thousands while still allowing them to enjoy the benefits of using an agent, such as being listed on RightMove, Zoopla, and Prime Location.

We asked our sample whether they would be willing to use an online estate agent given the opportunity to save money whilst moving home.

72% said Yes. They would be willing to use an online estate agent to save money when selling a property.

This data is a strong indicator of how homemovers feel about the fees charged by traditional estate agents. Many people are starting to value the cost savings over the convenience or expertise of a local service.

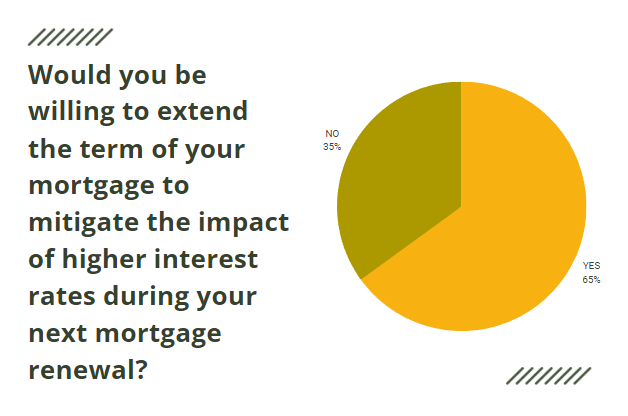

Extending the term of your mortgage means you'll pay less each month, but over a longer period of time. Because you'll be paying off your mortgage for longer, you'll pay more interest and so end up paying more overall. It's an option that provides short-term relief in exchange for longer repayments. Many Mortgage providers allow mortgage term extensions up to retirement age without too many questions asked. When moving home, it's a good chance to reassess your mortgage term as a way to bring your repayments back in line with your budget.

We asked our sample whether they would consider extending their mortgage term to mitigate the impact of higher interest rates.

65% of the sample would be willing to extend their mortgage term in a bid to mitigate the interest rate increases.

The data suggests a strong short-term concern for the impact of interest rate rises, with people willing to sacrifice paying a mortgage for a longer period to assist with managing costs. There may also be a lot of homeowners who may not have a choice but to act upon a measure such as extending their mortgage term.

Waiting for interest rates to fall as a tactic for saving money when choosing to move home can be a consideration, but it's important to approach it with a realistic perspective. Predicting interest rate movements is challenging, and timing the market carries risks. Additionally, delaying a move based on waiting for lower rates may result in missed opportunities and potential increases in property prices. Considering long-term factors and seeking professional advice can help evaluate the viability of this strategy based on individual circumstances and market conditions. Ultimately, it is crucial to weigh the potential benefits against the uncertainties and opportunity costs involved in waiting for interest rates to decrease.

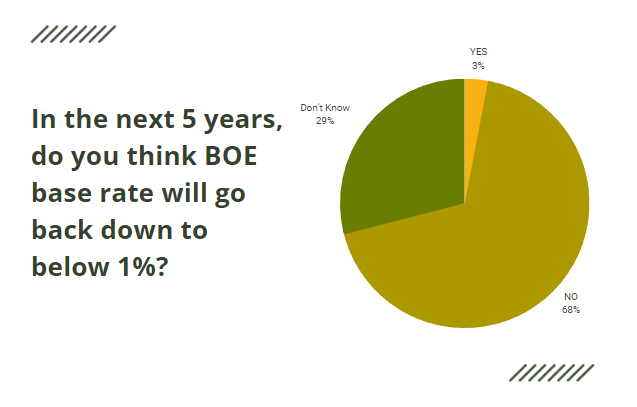

We asked our sample if they think the BOE base rate will fall back below 1% in the next 5 years.

Just 3% of our sample believe BOE base rate will fall back to below 1% in the next 5 years. 68% answered No, whilst 29% on the fence.

Confidence is low amongst homemovers to expect to see a base rate back below 1% in the next 5 years. Waiting for Interest rates to fall doesn't look like a tactic many people are willing to employ.

In conclusion, the survey results shed light on the complex dynamics between interest rate rises and individuals' moving plans. While interest rate fluctuations play a significant role in decision-making, alternative options such as exploring new counties, using online estate agents, and extending mortgage terms can offer potential solutions to mitigate the impact of rising rates.

It's crucial for homeowners to carefully evaluate their options and seek professional advice to make informed decisions that align with their financial goals and circumstances.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.