Achieving financial independence (FI) is a dream most people hold. However, the path towards this goal might seem daunting and complex.

In this extensive guide, you will learn how to FI by understanding its different types and the steps involved in calculating your unique FI number.

Moreover, you will discover strategies that could expedite your journey towards FI.

Financial independence refers to the state where one's passive income or savings can sufficiently cover living expenses without the need for active work. Attaining FI doesn't necessarily mean early retirement, but it does offer the liberty to choose whether or not to work. This freedom opens up opportunities to pursue passion projects, spend quality time with loved ones, or even explore entrepreneurial ventures.

There are different paths towards achieving FI. Understanding these will help you choose the most suitable approach for your specific goals and lifestyle.

Regular FI entails accumulating enough wealth and passive income to maintain your current lifestyle without the need for a traditional job. This allows you to focus on activities that genuinely inspire you or align with your passions.

Lean FI is a minimalist approach to financial independence. It involves a frugal lifestyle with reduced expenses to the bare essentials. With Lean FI, you aim to cover your basic needs, allowing you to achieve FI earlier and break free from traditional employment.

Fat FI is at the other end of the spectrum. It involves accumulating substantial wealth and passive income streams, allowing for a luxurious lifestyle. Fat FI provides the financial resources to indulge in desired experiences, extensive travel, or support causes important to you.

Barista FI offers a balance between traditional employment and full retirement. With enough savings and passive income to leave your main job, you can transition to less demanding or more enjoyable part-time or flexible work. Barista FI provides a balance between financial stability and fulfilling activities.

Coast FI is when you've saved and invested enough to let your assets grow without significant additional savings. This allows you to take a break from actively saving while still benefiting from the power of compounding.

Now that we have a clear understanding of what FI is, let's dive into the six steps that can guide you towards achieving financial independence.

Before setting out on your journey towards FI, it's essential to understand your current financial standing. Evaluate your income and annual spending, both present and projected. Review your bank account and credit card statements from the past 12 months to determine your average monthly expenses. Additionally, consider your expected income growth rate, promotions, or career advancements.

The Safe Withdrawal Rate (SWR) is a crucial component in your FI journey. It signifies the percentage of your investments that you can safely withdraw each year without exhausting your savings. The commonly used SWR is the 4% rule, which suggests that you can safely withdraw 4% of your initial retirement portfolio balance each year, adjusted for inflation.

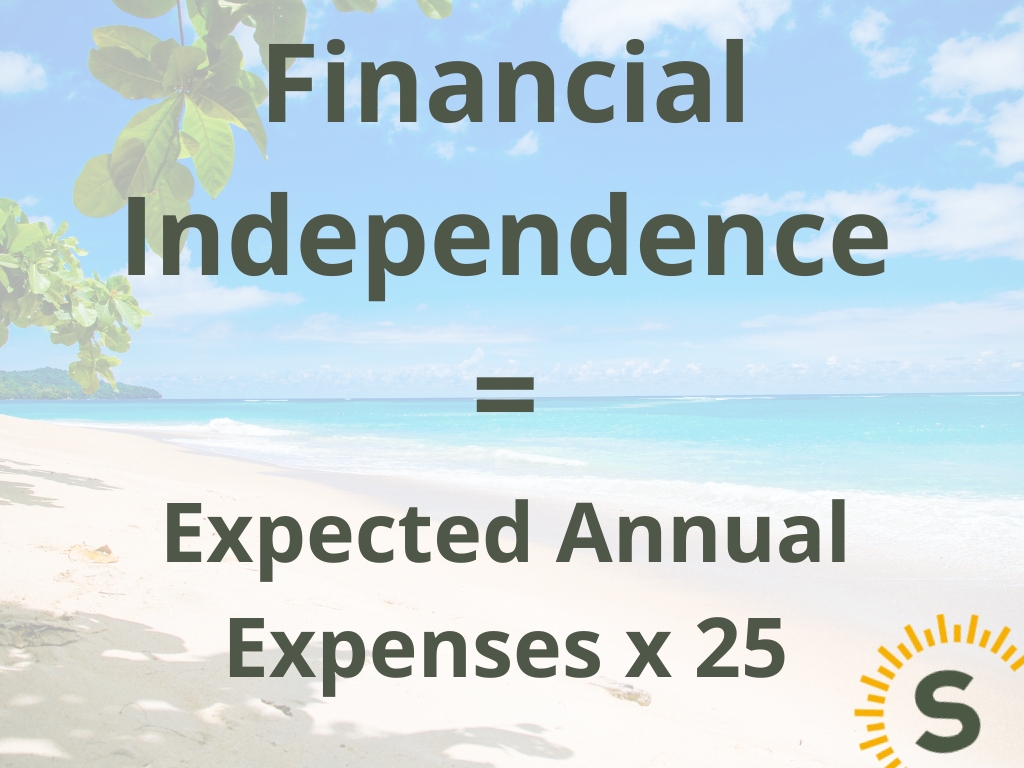

Your FI number represents the amount you need to sustain your desired lifestyle without relying on traditional employment. To calculate your FI number, multiply your yearly expenses by 25 (if you follow the 4% rule) or 33 (for a 3% SWR). This will give you a rough estimate of the amount you need to achieve FI.

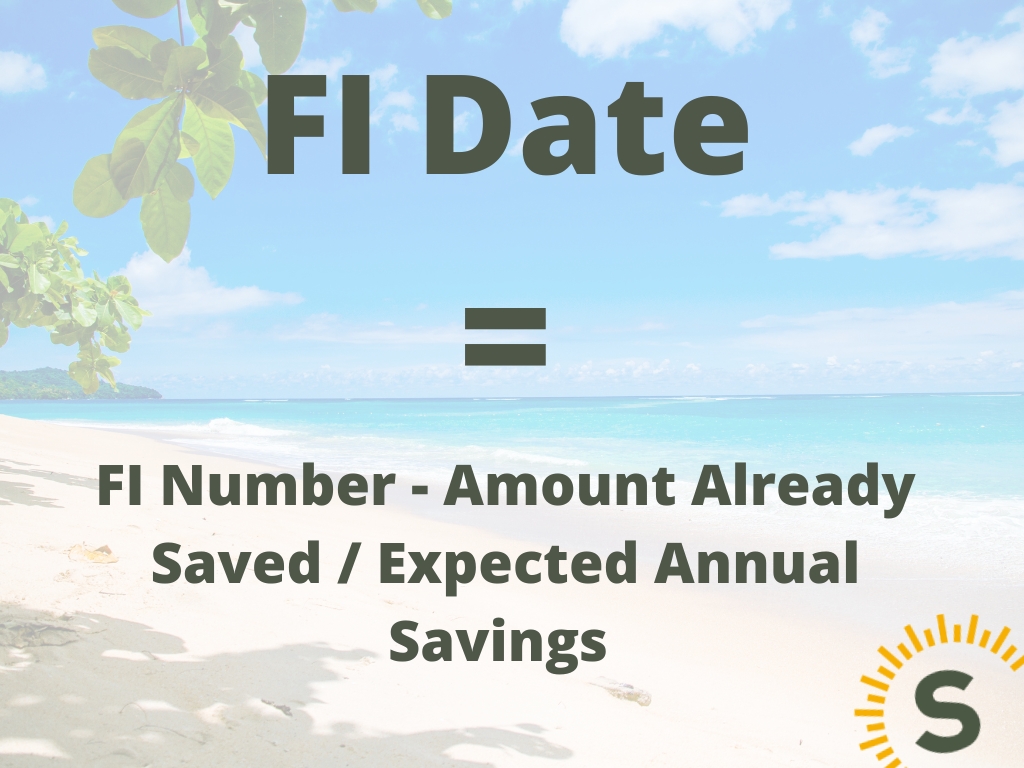

Once you have your FI number, it's time to estimate how many years it will take to reach that goal. This step will help you assess your progress and set realistic expectations. Subtract the amount you've already saved from your FI number and divide it by your yearly savings to get an estimate of the years to FI.

Increasing your savings rate is one of the most effective ways to expedite your journey to FI. You can do this by eliminating or reducing debt, cutting back on expenses, and increasing your income through promotions, side hustles, or other income-generating opportunities.

Investing your savings wisely is a critical step towards achieving FI. Opt for low-cost index funds for broad market exposure with lower fees or consider investment opportunities in rental properties or start a business.

To increase income and work toward Financial Independence (FI):

Combining multiple approaches can accelerate your journey to FI by increasing your overall income.

The time it takes to reach Financial Independence (FI) varies widely based on factors like current savings, expenses, investment returns, and savings rate. It could take anywhere from a few years to several decades. Calculate based on your unique situation.

With a FI target of £900,000 and an existing savings of £300,000, there's a gap of £600,000. If you save £40,000 annually, dividing £600,000 by £40,000 equates to 15. This suggests an estimated 15 years to achieve financial independence.

The cost to reach Financial Independence (FI) is determined by your annual expenses and the FI number you calculate. Multiply your yearly expenses by 25 to 33 (for a 3% to 4% Safe Withdrawal Rate) to estimate the amount needed to achieve FI.

If your annual living expenses are £30,000, applying the 4% rule indicates a FI goal of £750,000. Reaching this sum provides the means to sustain your chosen lifestyle independently.

Achieving FI is a journey that requires dedication and strategic financial planning. It's about setting clear financial goals, making informed decisions, and being consistent in your savings and investment planning efforts. Remember, the journey towards FI is unique for everyone, and there's no one-size-fits-all approach. Consider your personal financial situation, lifestyle, and long-term goals when planning your path to FI. With the right strategies and a disciplined approach, you can reach financial independence and enjoy the freedom and flexibility it brings.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.