Working out how much to offer on a house is a balancing act. If you're only after a great deal, making an offer too low may be considered a cheeky offer. This term is commonly used in property negotiations, but what is a cheeky offer on a house?

In this insight, we will explore the concept of a cheeky offer, the likelihood of acceptance, and how to decide just how cheeky to be.

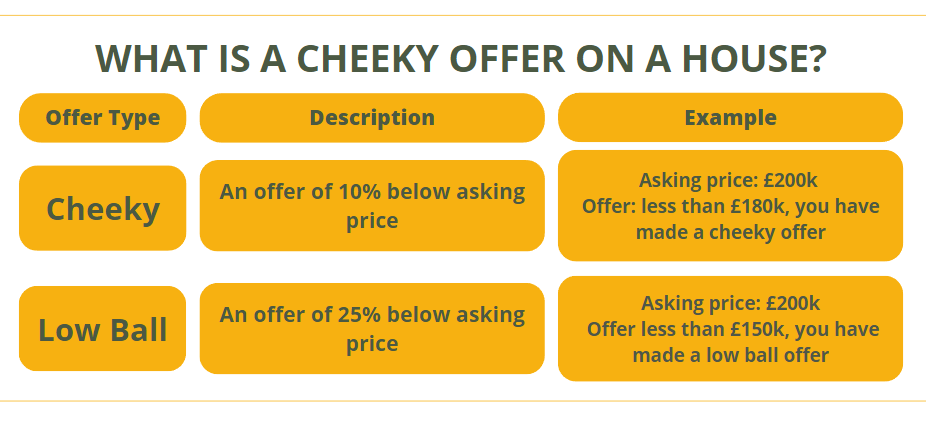

A cheeky offer on a house refers to an offer that is more than 10% below the seller's asking price, while a lowball offer goes beyond 25% of the asking price. Offering 15% below the asking price is generally considered a cheeky offer and not disrespectful.

If you go as low as 25% of the asking price, it is considered a low-ball offer. These terms aren't common to all, but these are terms sometimes used in the property market.

These offers are considered "cheeky" because by definition, they could "show a lack of respect". However, this is real life, there are no set rules. Do not shy away from making a cheeky offer. Just be aware that the chances of having your cheeky offer accepted will depend on several factors, such as the outcome of negotiations, the current state of the property market, and the motivation of the seller.

For example, a cheeky offer is more likely to be accepted by a motivated seller, someone desperate to sell.

A low offer can be perceived as insulting or disrespectful by some sellers, especially if it is significantly below the asking price without any justification. However, it's essential to remember that making an offer below the asking price is not inherently disrespectful and is part of the process of buying a house.

Sellers often expect potential buyers to negotiate, and sometimes, they may have overpriced their property in anticipation of this.

Yes, you can offer 15% below the asking price. In fact, this percentage is considered a cheeky offer rather than a disrespectful one. It is crucial to be careful when making such offers, as you don't want to offend the seller and risk them disregarding your offer entirely.

Keep in mind that offering 15% below the asking price might actually be closer to the property's actual value, as sellers and estate agents often overvalue properties by 5-10%.

Several factors can influence how much you should offer on a property and what constitutes a cheeky offer. Here are some key aspects to consider:

Conduct extensive market research to understand the current state of the housing market. This will help you determine if it is a buyer's or seller's market, and whether making a cheeky offer is advisable.

Investigate the sold price history of similar and local houses to gauge the appropriate offer for the property you are interested in. Sellers often inflate their asking prices, so knowing the actual selling prices for comparable properties can help you make a more informed offer.

The duration a property has been on the market can significantly impact the seller's willingness to accept a cheeky offer. If a house has been on the market for more than six months, it may indicate issues such as overpricing or structural problems. In such cases, the seller may be more inclined to accept a lower offer.

Consider your emotional attachment to the property and your relationship with the seller. If you know the seller personally or feel strongly about the property, you may be less inclined to make a cheeky offer.

Your financial situation plays a crucial role in determining how much you can negotiate. If you are a cash buyer, you have a stronger bargaining position, as there are fewer obstacles and less paperwork involved.

There are several scenarios where a seller might accept a cheeky offer:

Sellers in need of a quick sale are more likely to accept a cheeky offer. They may have already purchased a new property and need to sell their current property as soon as possible. In such cases, they may be more open to lower offers, especially from cash buyers.

If a property has been on the market for an extended period, the seller may be more willing to accept a cheeky offer. This could be because there is little demand for the property at the current asking price, or there may be underlying issues with the property that have deterred potential buyers.

If you have evidence or reasons to back up your low offer, such as poor survey results or high repair costs, the seller may be more inclined to accept your cheeky offer. They can either cover the repair costs themselves and maintain their asking price or accept your lower offer and leave the repairs to you.

Determining how much to offer on a house depends on several factors, including market research, sold price history of similar properties, the property's time on the market, your personal interest in the property, and your financial position. Here are some steps to help you calculate an appropriate offer:

By taking these factors into account, you can make a cheeky offer that is more likely to be accepted by the seller and secure your dream property at a reasonable price.

While it may seem counterintuitive, there are instances when offering more than the asking price is advisable. This is often the case in highly competitive property markets with high demand and low supply. In such situations, potential buyers may need to outbid each other, driving the final sale price above the asking price.

However, it is essential to ensure that any offer above the asking price is within your budget and will not ruin your mortgage options or financial stability.

If your cheeky offer is turned down, you have several options:

Emotions can play a significant role in the house buying process, especially when it comes to making cheeky offers. If you are emotionally attached to a property, you may be less willing to make a cheeky offer, fearing that it could impact your chances of securing the property.

In such cases, it is essential to objectively assess the property's value, market conditions, and your financial position to make an informed decision.

Offering the asking price or more on a property should only be considered in specific circumstances:

In these situations, it is crucial to ensure that your offer is within your budget and will not adversely impact your financial position.

Making a cheeky offer on a house can be a delicate balancing act. While aiming for the best possible deal, it is essential not to offend the seller. Equally, there is no benefit in being cheeky if you find your forever home, but lose out because you've offered far too little.

Consider the factors in this insight and that will leave you left to make your own mind up on the question, what is a cheeky offer on a house? However, when it comes to what % is a cheeky offer on a house, it's at least 15% below the asking price.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.