The question of whether it's a good time to buy a house in the UK is one that many potential homebuyers may be pondering. With fluctuations in property prices and mortgage rates, it's essential to assess the current market conditions before making such a significant financial decision.

In this insight, we will explore the various factors to consider when determining if now is the right time to buy a house.

Deciding if it is a good time to buy a house requires careful thought. If you find an affordable home and plan to stay for at least 5 years, it's a good time. If investing or waiting for lower prices, keep an eye on interest rates in the coming months.

Sooner or later, inflation will drop which could mean the Bank of England reduce interest rates to combat economic decline. When that happens, the cost of borrowing will reduce, making mortgages cheaper. However, if you don't act soon enough, lower interest rates could also restart house price growth.

When buying a house, you should try to balance the emotions of it being an investment as well as your home. Consider the signs that the housing market will crash.

The latest data on the current state of the UK housing market reveals a nuanced landscape. Average new seller asking prices have seen a marginal uptick of 0.4%, equivalent to £1,386, bringing the average price to £366,281. This increment is notably lower than the typical seasonal trends for this time of year.

However, the annual price change paints a different picture, with a decline of -0.4%, marking the most substantial drop since March 2019.

The subdued market activity is attributed to a combination of factors, including recent interest rate hikes and the distractions of summer holidays for both buyers and sellers. This has led to price reductions creeping up to levels not witnessed since January 2011.

Currently, 36.3% of properties listed for sale have undergone price reductions, with the national average reduction amounting to £22,700, equivalent to 6.2% of the property's initial listing price.

The number of property sales agreed in August across all types has seen a significant decrease of 18% compared to August 2019. However, within this shifting landscape, the first-time buyer sector, primarily comprising properties with two bedrooms or fewer, remains relatively resilient, with sales agreements down by 13% compared to 2019.

In more recent developments, there are signs of increased activity, particularly with the return of back-to-school sellers. The number of new properties entering the market surged by 12% in the first week of September, a notable increase when compared to the average weekly numbers throughout August.

There is a silver lining for prospective buyers, as mortgage rates continue to fall. The average five-year fixed mortgage rate currently stands at 5.67%, marking the seventh consecutive week of declines. This comes after reaching a peak of 6.11% in July.

In summary, the UK housing market is navigating through a dynamic and evolving landscape, with various factors influencing its trajectory.

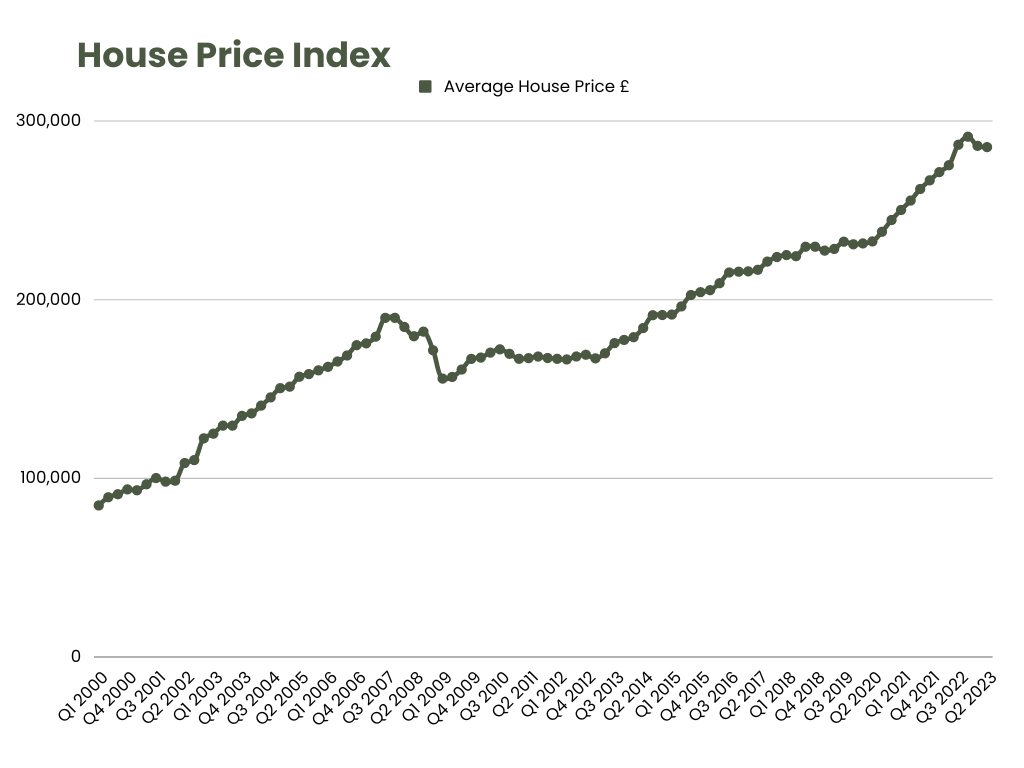

The house price index provides lagging data after the official sold prices come through. However, the latest data for Q2 tells a different story with house price data still reporting to be quite flat.

The anticipated decrease in inflation is poised to have a significant impact on the economic landscape. As inflation is expected to ease in the coming months, it may prompt the Bank of England to consider lowering its base interest rate.

This move could result in reduced mortgage costs for borrowers. Lower inflation typically signals a more stable and affordable pricing environment, which can benefit consumers by making borrowing cheaper.

A potential reduction in the base rate would not only provide relief to existing homeowners with adjustable-rate mortgages but also offer an attractive opportunity for prospective homebuyers to secure more affordable financing options.

However, the delicate balancing act of managing inflation while sustaining economic growth remains a key challenge for central banks, and any policy adjustments will need to consider broader economic factors.

Besides the ups and downs in mortgage rates, there are other money-related factors that can impact a household's ability to buy a house. One key thing to think about is the overall cost of living, which has been a hot topic lately because it's becoming harder for many people to afford things.

If you're considering buying a home, you should carefully look at your financial situation to make sure you can comfortably handle the ongoing costs of homeownership, like utility bills and home maintenance.

Speaking of utility bills (the money you pay for gas and electricity), there are some changes coming. Ofgem, a group that oversees energy prices, is going to make sure that the average household's energy bill goes down to £1,923 in October. That's good news because it means people will have to spend less on energy. But here's the catch: even though energy bills are going down, some help from the government that used to make bills even lower is going away. So, even with the lower energy bills, many people might not see a big change in how much money they have to spend.

This means that families need to be really careful with their money and plan things out well if they want to buy a house, especially with all these changes happening in the economy.

It's worth noting that first-time buyers seem to have played a significant role in the housing market's recovery. According to Rightmove, demand for properties with two bedrooms or fewer, typically preferred by first-time buyers, reached a new record price of £225,244 in September.

This indicates that first-time buyers are actively participating in the market, despite the challenges posed by rising prices and mortgage rates.

To determine whether it's a good time to buy a house, let's consider the pros and cons of entering the market at this point:

With decreased demand and prolonged time on the market for properties, buyers may have the opportunity to negotiate a discount off the asking price.

Fixed mortgage rates have become more favourable compared to discounted and tracker rates. Fixed rates have fallen in recent months, while discount and tracker rates have continued to rise due to subsequent Bank of England base rate increases.

This makes fixed rates a more attractive option for buyers.

The number of mortgage products on the market has risen, providing buyers with more choices and fostering competition among lenders. This increase in availability can ultimately lead to more competitive rates for borrowers.

Buyers who made offers on houses in the past six months with a 5% to 10% deposit may face the risk of negative equity. With house prices forecasted to decline by up to 15% by the end of the year, it's possible that the value of the home may be less than the outstanding mortgage balance.

The current volatility in the housing market may cause some buyers to hesitate. Uncertainty surrounding mortgage rates, inflation, and the overall economic climate can make potential buyers question whether now is the right time to enter the market.

Deciding whether to buy a house now or wait until 2025 depends on several factors. If you find an affordable home and plan to stay long-term, it may be a good time to buy, especially with decreasing mortgage rates. If you're waiting for potentially lower prices, monitor interest rates and consider the risks that interest rates may rise further yet.

Assess your financial situation, affordability, and ongoing homeownership costs. Carefully consider market volatility, negative equity risk, and economic uncertainty.

Determining whether it's a good time to buy a house in the UK requires careful consideration of various factors. While house prices have experienced some fluctuations and mortgage rates have fallen, buyers must also assess their own financial situation, including affordability and ongoing costs. The potential for discounts and increased mortgage product availability can be advantageous for buyers, but the risk of negative equity and market uncertainty should also be weighed.

Ultimately, the decision to buy a house should be based on individual circumstances, long-term financial goals, and a thorough assessment of the current market conditions. Consulting with a trusted financial adviser or mortgage broker can provide additional guidance and support in making this important decision.

Use our Mortgage affordability calculator to calculate your mortgage costs.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.