International Wealth Management (also known as International Financial Planning, or Cross-border Financial Planning) is where banking services are arranged for either non-UK residents (including ex-pats) or UK-domiciled individuals with assets overseas.

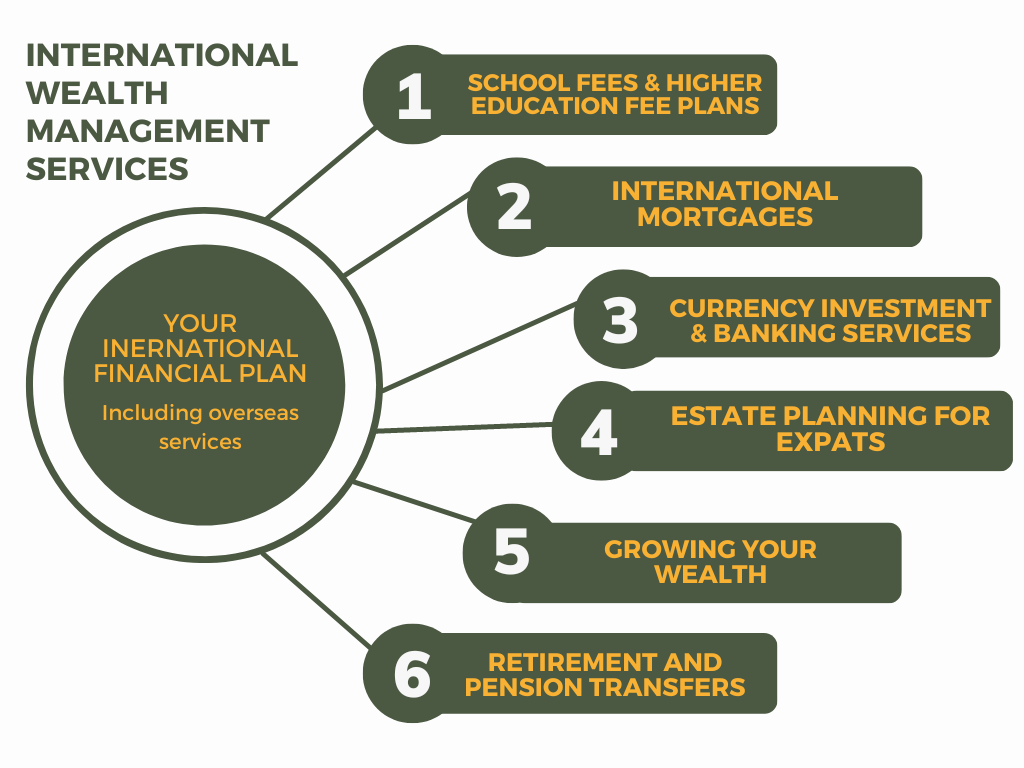

An international financial planner can provide international wealth management services including:

Advising clients on their overall financial situation, setting goals, and creating a comprehensive plan to achieve financial objectives, taking into account international considerations.

Providing investment planning, asset allocation, and portfolio management to help clients make informed decisions in global financial markets.

Assisting clients in planning for their retirement by evaluating income needs, exploring pension options, and developing strategies to accumulate and manage wealth across international jurisdictions. Transferring pensions when moving abroad can be complicated. International Wealth Management services can assist with this process.

Advising on tax-efficient strategies to minimise tax liabilities, considering international tax laws, treaties, and regulations that may impact individuals or businesses with cross-border interests.

Helping clients plan the distribution of assets and wealth across different jurisdictions, considering international estate laws, taxes, and succession planning.

Assessing and managing risks associated with global investments, insurance coverage, and other financial aspects, including currency risk, geopolitical risk, and regulatory compliance.

Assisting clients in navigating international banking services, offshore investments, and wealth management solutions tailored to their unique needs and objectives.

Providing guidance on cross-border transactions, international money transfers, currency exchange, and financial services specific to global mobility, expatriates, or international businesses.

International Financial planning has become a specialist area of personal financial advice as client needs can often be complex when dealing with international law.

International wealth management is important for several reasons. First, it provides individuals with access to a diverse range of investment opportunities beyond their domestic market. By investing internationally, individuals can tap into different asset classes, industries, and economies, potentially diversifying their risk and enhancing their potential returns.

Second, international wealth management offers asset protection and privacy benefits. Certain jurisdictions provide favourable legal and regulatory frameworks that help individuals safeguard their wealth, maintain confidentiality, and shield assets from risks such as lawsuits, political instability, or changes in domestic laws.

Third, it enables individuals to optimise their tax strategies. International wealth management takes advantage of international tax treaties, jurisdictions with lower tax rates, and legal structures that minimise tax liabilities. This approach allows for tax-efficient wealth accumulation, estate planning, and succession strategies.

Lastly, international wealth management is essential for individuals with global mobility and expatriation. It helps them navigate complex tax systems, currency fluctuations, regulatory requirements, and cross-border investment considerations, ensuring their financial affairs are well-managed and compliant.

International wealth management services are typically available to individuals who have cross-border financial needs or hold assets and investments in multiple countries. While eligibility may vary among financial institutions and advisers, the following individuals often seek international wealth management:

These individuals have significant wealth and complex financial portfolios that extend beyond a single country. They require specialised services to manage their global assets, investments, and tax planning strategies.

Individuals who live or work abroad, whether temporarily or permanently, often have unique financial considerations. They may require assistance with international tax compliance, cross-border banking, retirement planning, and investment management to optimise their financial situation in multiple jurisdictions.

International wealth management is crucial for business owners and entrepreneurs who operate globally, have international business interests, or plan to expand their ventures across borders. They may need guidance on structuring their businesses, managing international cash flows, mitigating tax implications, and succession planning.

If you hold investments, real estate, or other assets in multiple countries, international wealth management can help you navigate the complexities of cross-border investment strategies, estate planning, and asset protection. This includes diversifying investments across different markets and currencies while considering local regulations and tax implications.

Families with members living in different countries or with diverse financial interests benefit from international wealth management. These services can assist in coordinating family wealth, establishing trusts, managing inheritances, and implementing succession plans that span across various jurisdictions.

While these are common examples, eligibility for international wealth management ultimately depends on the specific requirements and offerings of the financial institution or adviser. It is recommended to consult with an international wealth management professional to determine if their services align with your needs and circumstances.

The impact of international regulations on expats is a crucial consideration when it comes to financial services.

When you relocate from the UK to another country, international regulations can significantly affect various aspects of your financial affairs. An international financial adviser can guide you in understanding and complying with the legal requirements in your new jurisdiction. For instance, if you have a will in the UK and move abroad, it may need to be reviewed and updated to align with the laws and regulations of your new country of residence.

International regulations can have implications for your financial planning strategies. An international financial adviser can help you navigate complex international tax laws, investment regulations, and retirement planning considerations. They can provide guidance on optimising your financial situation, taking advantage of available tax benefits, and ensuring compliance with reporting requirements in both your home country and the country where you reside.

Moving abroad may require you to reassess your protection strategies. International regulations can impact the structuring and safeguarding of your assets, including real estate, investments, and business interests. An international financial adviser can assist you in developing comprehensive asset protection plans that consider the legal and regulatory frameworks in different jurisdictions, helping you safeguard your wealth and mitigate risks.

In summary, International Wealth Management offers comprehensive financial services, ensures compliance with international regulations, and provides asset protection and optimisation. By utilising these services, individuals can navigate the complexities of their international financial affairs, make informed decisions, and achieve their financial goals with confidence.

Also known as an Expat Financial Adviser. An international financial adviser is a specialist financial adviser qualified in offering international banking services to their clients. Services include pensions, estate planning, multi-currency investment advice, non-sterling banking facilities, tax planning and investment consultancy. This is offered to clients who are either expats (non UK-Domiciled) or UK individuals with assets overseas.

Each country usually operates within its own financial rules, tax and regulations. Experience is valuable when navigating these markets. Specialists in this area tend to have a unique understanding where other Financial Advisers may not feel able to offer these services or are not qualified to do so.

International Financial planners can offer advice around: lifestyle financial planning (general banking services, current accounts & mortgages). International School fee's, Inheritance tax planning, trust planning & Will writing, health, life & income protection insurance, retirement planning, repatriation, international mortgages.

Yes, non UK domiciled clients can be looked after by an International Financial adviser. They have a greater understanding of regulatory requirements for servicing international clients and offer advice around international banking services such as international mortgages.

Expat financial services are offered by International Financial advisers. Sunny Avenue has spent time vetting advisers and services up and down the country. You will able to use our directory to search via post code or services offered to help you find your ideal International Financial adviser.

A mortgage provided by an international financial services provider secured on a property in a country other than where you live. This is usually advised upon by an international financial adviser. It can also involve either borrowing for purpose of buying a home in a different country or making repayments using a different currency.

No minimum

No minimum  Leicester, Leicestershire

Leicester, Leicestershire Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

Discover the importance of a fact find in financial planning

A guide to Pension transfers, how to arrange one, moving pensions abroad and seeking the correct advice for you

Are you considering moving abroad and wondering what to do with your pension? What is a QROPS and why is it important?

School Fee Planning puts a plan in place so you hit your school fee target in a way that is tax efficient and quick