Yes. Equity release loans can be repaid if you sell your house. You can pay the loan in full or transfer it to your new home, but your lender needs to be informed and approve any move.

Are you considering selling your home but unsure if you can do so if you have an equity release plan? Perhaps you're curious about what equity release even is and how it impacts the selling process. You're not alone. The answer is not as straightforward as you might think, and there are some surprising and little-known factors to consider. So, can you sell your house with equity release?

In this insight, we will explore your options.

It is possible to move home and take your equity release with you. Your equity release lender will need to agree to the move. This agreement will depend on a reassessment of your circumstances. These circumstances include:

When moving home with equity release, you will need to have enough equity in your new property for the loan to be switched. This means that if you are downsizing with a mortgage, you may not have enough equity in the new home to finance the switch. It's important to check with your equity release lender and new mortgage lender to ensure you have enough equity to make the move.

Let's say you released £100,000 of equity on your current home, and the outstanding debt on your equity release plan is now £120,000 due to compounded interest. You decide to downsize and move to a new property worth £200,000 with a mortgage of £50,000. The equity you have available in the new property is only £30,000, which is not enough to repay the outstanding debt on your equity release plan. In this case, you would not be able to switch your equity release plan to your new property.

When you take out a mortgage on your new property, your mortgage lender will insist on being the first charge on the property. This means that in the event of repossession, they will receive the money for the mortgage before the equity release lender is repaid. It's important to check that your new mortgage lender allows for this.

When considering taking your equity release with you to a new property, it's important to note that the minimum property value accepted for equity release is £70,000. However, it's essential to check with your equity release lender as some may require a higher minimum property value.

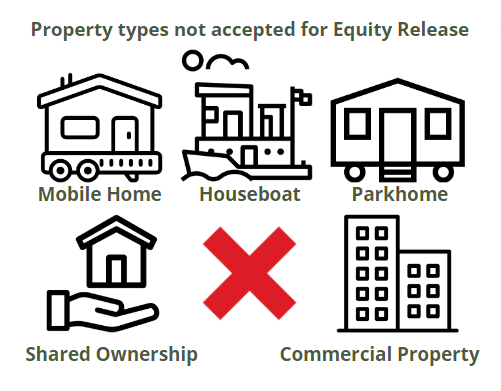

Not all property types are eligible for equity release, so it's important to check if your new property is acceptable. Shared ownership, houseboats, mobile homes, and park homes are not usually accepted. But, leasehold and retirement accommodation properties are generally acceptable.

If the outstanding interest amount on your equity release agreement exceeds the equity you'll have available in your new property, you may not be able to move. It's important to ensure the new property's equity can cover the interest amount.

It's important to consider portability. If your lifetime mortgage meets the Equity Release Council standards, it will be portable. However, if you have an older product that predates the council's introduction in 1991, it may not be eligible to switch.

If you do not meet the criteria to move your equity release loan to your new property, there are some alternatives for you to consider:

Note: You will not be able to rent your property out if you have equity release on it. This is not an allowable alternative option.

If you want to sell your home but you have an equity release plan, you can contact your provider to see if you can transfer the plan to your new home. If your provider is part of the Equity Release Council, they should let you move the plan to a home that they think is a good choice. They'll need to check the new home to make sure it's suitable. If they approve, they'll move the plan to the new home. This is called 'porting'. If your new home is worth less than your old one, you might need to pay back some of your loan from the money you get from selling your home. However, not all homes can be used as a replacement for your old home.

You can repay an equity release product at any time, such as when you sell your home. However, you should keep in mind the outstanding interest amount and any early repayment charges that may apply.

If you pay off your equity release loan early, you might have to pay an early repayment charge. This fee helps cover the costs the lender incurred to set up the loan, and it's usually a percentage of the borrowed amount plus the outstanding interest. The amount of the charge varies depending on your lender and your agreement, and it can be found in the key facts illustration document provided when you first took out the loan. Early repayment charges can range from 3-7% and may decrease over time, such as from 5% in the first 5 years to 3% thereafter.

For example, let's say you took out an equity release loan for £200,000 with an early repayment charge of 5% in the first 5 years. If you decided to repay the loan in full after 3 years, you would owe an early repayment charge of £10,000 (5% of £200,000). However, if you waited until after the 5-year period, the early repayment charge would reduce to 3%, meaning you would owe £6,000 instead. It's important to check the terms of your specific equity release agreement to understand any applicable early repayment charges.

If your equity release lender includes downsizing protection, you will have more flexibility when moving to a new property. This clause allows you to repay your equity release loan back in full without facing any early repayment charges if you decide to move. This is not limited to downsizing, and can also apply if you are up-sizing or moving to a property of the same value.

If you were a homeowner who has taken out a lifetime mortgage. Over time, the value of your home has increased, and you now have a significant amount of equity tied up in the property. However, you have reached a point in your life where you no longer need such a large home and would like to downsize to a smaller property.

Normally, if you were to sell your home and repay the lifetime mortgage, you would incur fees and penalties. However, if your lifetime mortgage included downsizing protection, you would be able to sell your home and repay the equity release without incurring a fee, provided that you are downsizing to a smaller property that meets certain criteria that is sometimes required. For example, the downsizing protection might specify that you must be moving to a property that is at least 50% of the value of your current home, or that you must be moving to a property that is more suitable for your needs, such as a retirement community.

Downsizing protection does not apply to home reversion plans.

If you're considering selling your home to repay your equity release, start by talking to your lender. To help you make an informed decision, ask about:

Understanding these details can help you decide whether selling your home is the best option for repaying your equity release, and can help you avoid unexpected fees or complications.

If you're unsure where to get started with Equity Release advice, complete the Sunny Fact Find for Mortgage advice. The answers you provide help us to find the best-suited adviser for your needs. The adviser then contacts you to discuss how they can help. You decide how to proceed.

Yes, in some instances, you may choose to settle your old equity release debt, and open a new agreement. This might be favourable for interest rates or provide greater flexibility.

It is not allowable to let out your property whilst you have equity release. The property you release equity on must be your main residence. It cannot be a property rented out or a holiday home.

Yes, you will require a valuation to be completed if you intend to move and switch your borrowing to your new property. Your lender will decide if a physical or digital valuation is needed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Leyland, Lancashire

Leyland, Lancashire No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£51,000+

£51,000+  Sheffield, South Yorkshire

Sheffield, South Yorkshire No obligation consultation

No obligation consultation

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.