Children's critical illness cover is a type of life insurance that provides cover for children. If the child suffers one of the critical illnesses listed in the policy then a claim is paid. The amount of cover available depends on the individual policy.

In this insight, we will cover all you need to know about protecting your children via critical illness cover.

Children's critical illness cover is an insurance policy that provides financial protection for parents in the event that their child is diagnosed with a serious illness.

Children's critical illness cover can be purchased as a standalone policy, or as an add-on to a parent's existing life or critical illness policy. Parents make monthly payments for the cover which extends to their children. Alternatively, joint policies are also available which can include children's critical illness cover. This provides peace of mind that in the event of a serious illness, the financial impact can be alleviated, allowing the family to focus on their child's recovery.

Here's an example of how it might work:

Let's say that a family has a child who is diagnosed with leukemia. The parents have taken out a children's critical illness policy that provides a lump sum payment of £50,000 in the event that their child is diagnosed with a critical illness covered by the policy.

Upon receiving the diagnosis, the parents contact the insurance company and provide the necessary medical documentation. The insurance company then reviews the claim and, assuming that the illness is covered by the policy and the child meets the policy definition of a critical illness, pays out the £50,000 lump sum to the parents.

The parents can then use this money to cover any expenses related to their child's illness, such as medical bills, travel costs for treatment, or even time off work to care for their child. This financial support can help to alleviate some of the stress and worry that comes with having a seriously ill child and allow the family to focus on providing the best possible care and support for their child during this difficult time.

The money can be used in anyway. It is normally used to help pay towards care costs, or allow a parent to take time off of work. Some people choose to use the money to pay for hotel costs so they can stay near their child.

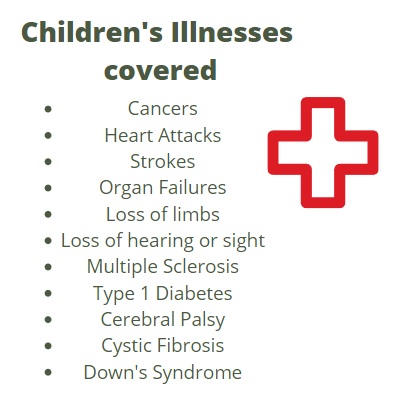

The illnesses covered are the ones normally included in an adult's policy. Some are included that are more likely to arise in children. The core illnesses include Cancer, Heart attack or other organ failures. Other illnesses for children include type 1 diabetes, down syndrome and Cerebral palsy.

Cover can vary depending on the policy provider. There are some insurers who offer cover up to £100,000. In most policies, the cover is the minimum of 25-50% of the adult value, or £25,000.

If you have a claim paid for your children's cover, your main policy will not stop. You will be able to claim the full amount later if it is required.

The age that cover can run to depends on the individual insurer. Some policies include cover up to 23 years old.

Every year, an average of 2,400 new cases of cancer are diagnosed in children under the age of 18, according to Cancer Research UK. That's almost six cases every day. While it may be a difficult topic for parents to consider, having children's critical illness cover can provide valuable protection. This coverage can either be purchased as a standalone policy or as part of a parent's life or critical illness policy. Some joint policies also offer Children's Critical Illness cover as an option.

It's worth noting that some policies may include Children's Critical Illness cover at no additional cost. However, it's important to carefully consider the benefits and limitations of such coverage before deciding whether it's worth it for your family.

Factors to consider include:

It's difficult to put a cost on critical illness cover as it's important to have a comprehensive cover that is right for you. You will be quoted an individual price based on your needs.

Policies have a few variables that can impact price. This includes:

Most insurers will allow you to add Children's critical illness cover to your existing policy. It's normally cost-efficient to do this.

When reviewing your insurance, it is recommended to speak with an adviser to make the conversation easier and get help determining how much cover you need. An adviser can also assist in arranging a policy that runs for the appropriate length of time for your child's cover. They may suggest a decreasing basis policy, which aligns with a debt you are paying back. By seeking advice, you can avoid paying extra or having insufficient cover.

If you're unsure where to get started with seeking protection insurance advice, you can complete the Sunny Fact Find. The answers you provide help us to find the best-suited adviser for your needs. They then contact you for a no obligation-conversation on how they can help. You decide how to proceed.

In the tragic event that your child passes away, some insurance providers will contribute up to £4,000 towards the costs of a funeral.

Most policies allow for cover for all of your children. However, they will only pay a maximum amount of 2 children's critical illness claims per policy.

Yes. If you do not have children, you can choose to not include any form of children's critical illness cover,

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

£51,000+

£51,000+  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Leicester, Leicestershire

Leicester, Leicestershire Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.